- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 29, 2013

January 29

January 292013

Loonie Rises for Second Day

The Canadian dollar rose today for the second trading session after the huge drop against the US dollar and the euro that has started in the middle of this month. The bounce was supported by favorable fundamentals, including rising stocks and commodities. Analysts said that CAD rebounded after reaching some key technical levels. Crude oil advanced as much as 1 percent to $97.39 per barrel in New York. The Standard & Poorâs 500 […]

Read more January 29

January 292013

EUR/USD Reaches Highest Rate Since 2011

The euro rose today, erasing its previous losses versus the Japanese yen and touching the highest level since December 2011 against the US dollar, as the sentiment of German consumers was stable this month. The currency fell against the Great Britain pound. The GfK German Consumer Climate remained almost unchanged at 5.8 in January amid optimism of German consumers. The positive data added to last week’s favorable German ZEW Economic Sentiment, […]

Read more January 29

January 292013

US Dollar Drops as Consumer Confidence Falls

US dollar is broadly lower today, losing ground today as the macroeconomic picture internationally is at odds with the latest economic data out of the United States. The macroeconomic picture continues to be somewhat encouraging, with China showing that it is ready to pick up the economic pace, and with the situation appearing to improve in the eurozone, thanks to the fact that Germany appears ready to lead the way once again. With that […]

Read more January 29

January 292013

UK Pound Finds Respite for Now

UK pound has found some respite from its downward spiral — at least for now. Pound is higher against many of its major counterparts right now as Forex traders take a break from sending the currency on its plunge. UK pound has been rather weak recently, plunging lower against other major currencies. The weakness has been rather pronounced, and it appears that, for now, the pound is […]

Read more January 29

January 292013

AUD Rises vs. USD, Drops vs. JPY amid Mixed Fundamentals

The fundamental data was mixed for the Australian dollar today. As a reflection of that, the currency rose against its US peer, but dropped against the Japanese yen. The Conference Board reported that the Australian leading indicators fell 0.2 percent in November, reversing the 0.2 percent gain in the previous month. Meanwhile, National Australia Bank reported that business confidence jumped sharply to 3 in December, rebounding from the November level of -9, which was […]

Read more January 29

January 292013

NZ Dollar Climbs as Trade Deficit Turns to Surplus

The New Zealand dollar climbed today after New Zealand’s trade balance made a very pleasant surprise for market participants, unexpectedly turning from deficit to surplus last month. The currency retreated versus the Japanese yen. The New Zealand trade balance posted the surplus of NZ$486 million in December. That was completely unexpected by analysts as they have anticipated a deficit of NZ$106 million. The surplus was biggest since 1991. Moreover, the November […]

Read more January 29

January 292013

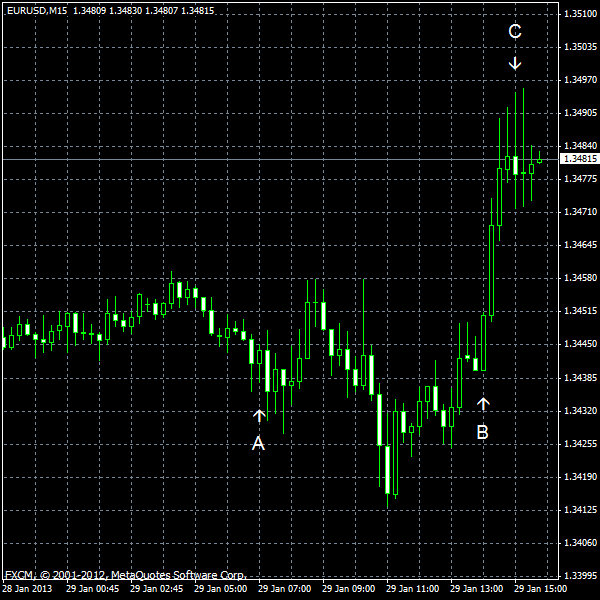

EUR/USD Climbs to Highest Since 2011

EUR/USD was falling today, but later rebounded and touched the highest rate since December 2011. The Forex market is in the risk-on mode and that drives the currency pair higher. The US data was mixed today as the housing market continued to show signs of strength, but consumer sentiment dropped more than was expected. As for news from Europe, the German consumer climate was stable, indicating that the economic environment in Europe […]

Read more January 29

January 292013

CAD/JPY Drops as Moody’s Downgrades Canadian Banks, Rebounds

The Canadian dollar fell against the Japanese yen today after Moody’s Investor Service cut credit ratings of several Canadian banks. Later, the loonie erased losses. The currency gained versus the US dollar and the euro. Moody’s downgraded long-term rates of six Canadian banks by one notch yesterday. David Beattie, Moody’s Vice President, said: Today’s downgrade of the Canadian banks reflects our ongoing concerns that Canadian banks’ exposure […]

Read more January 29

January 292013

Yen Rebounds After Huge Drop

The Japanese yen rose today, advancing for the second session and rebounding from the lowest level since 2010 against the US dollar, on speculations that the recent drop was excessive and on hopes for improvement of the Japanese economy. Traders were buying yen on view that the huge decline, that currency was experiencing since the new government had taken power, was excessive. Additionally, specialists predict that the Japanese economy may improve over […]

Read more