- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 1, 2013

February 1

February 12013

Weakness of Canadian Dollar Does Not Hurt CAD/JPY

The Canadian dollar weakened today as crude oil declined and on concerns that nation’s unemployment rose last month. The currency continued to advance versus the Japanese yen as Canadian economic growth accelerated. Crude oil futures dropped as much as 1 percent to $96.51 per barrel in New York. Analysts fear that next week’s report will show an increase of unemployment from 7.1 percent to 7.2 percent. Losses were limited and the rally […]

Read more February 1

February 12013

US Dollar Falls on Enthusiasm over Global Economic Data

US dollar is falling today as better news from around the world boost risk appetite. As Forex traders become enthusiastic about risk assets, looking for yields rather than safe haven. A raft of economic data was released earlier, indicating that the global economy has been moving in a recovery direction, and that has many Forex traders excited about high beta currencies. As a result, the greenback is headed […]

Read more February 1

February 12013

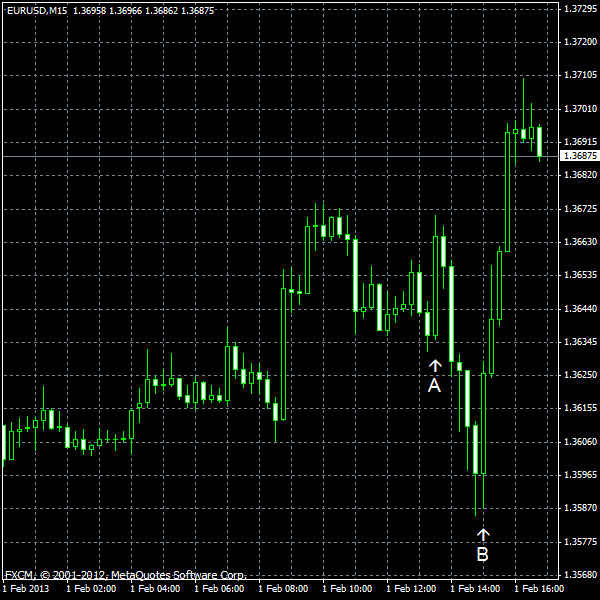

Euro Continues to Gain as Better Data Comes In

Euro is getting a boost today, moving through the 1.3600 level against the US dollar as better economic data comes in. Signs of stabilization in the euro zone are supporting the 17-nation currency. The latest economic data out of the eurozone is quite encouraging, pointing to stabilization in the region. First of all, the decline in eurozone manufacturing activity eased for the month of January. On top of that, inflation and unemployment both appear to have stabilized. The news is […]

Read more February 1

February 12013

GBP/USD Drops as UK PMI Falls, GBP/JPY Highest Since 2010

The Great Britain pound tumbled against the US dollar today as the UK manufacturing fell more than was anticipated by analysts. The currency continued to rise against the Japanese yen, reaching the highest price since February 2010. The Markit/CIPS UK Manufacturing Purchasing Managers’ Index fell from 51.2 in December (which was the highest in 15 months) to 50.8 in January. Experts have hoped for a reading of 51.0. The figure above 50.0 still indicated […]

Read more February 1

February 12013

NZ Dollar Rises, Gains Limited as China’s PMI Drops

The Zealand dollar rose today, but gains were limited as official data showed that China’s manufacturing growth slowed last month, damping prospects for New Zealand exports. The China Federation of Logistics & Purchasing reported that the Purchasing Managers’ Index fell from 50.6 in December to 50.4 in January. At the same time, the HSBC China Manufacturing PMI edged up from 51.5 to 52.3. It was the rare occurrence that […]

Read more February 1

February 12013

Positive US Data Propels EUR/USD to Highest Since 2011

EUR/USD jumped today, reaching the highest level since November 2011, as favorable data from the United States reinforced the positive market sentiment. Most reports today were better than expected, with the exception of the unemployment rate, which unexpectedly rose. Nonfarm payrolls rose 157k in January, in line with the forecast of 161k. The December growth was revised positively from 155k to 196k. The unemployment rate unexpectedly climbed by 0.1 percentage […]

Read more