- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 5, 2013

February 5

February 52013

GBP/USD at Lowest Since August, GBP/JPY Near Record Since 2010

The Great Britain pound fell to the lowest level since August against the US dollar even as domestic fundamentals were supportive for the currency. The sterling traded near the strongest rate since January 2010 versus the Japanese yen. British Retail Consortium reported that like-for-like retail sales grew 1.9 percent in January after the 0.3 percent increase in the prior month. The Markit/CIPS UK Services PMI advanced from 48.9 in December to 51.5 […]

Read more February 5

February 52013

Euro Regains Strength, Policy Makers Unlikely to Intervene

The euro jumped today following yesterday’s slump as unexpectedly favorable macroeconomic data increased attractiveness of the currency, while hopes that policy makers will not prevent appreciation added to the euro’s strength. Fears of the political turmoil in Europe abated, reducing pressure on the shared currency of the eurozone. At the same time, several positive report were released, including the eurozone composite Purchasing Managers’ Index that rose from 48.3 to 48.6 in January even […]

Read more February 5

February 52013

Japanese Yen Lose Ground to Other Majors

Japanese yen is losing ground today, heading lower after some show of strength earlier. Yen is retreating as the situation looks to be changing from one of risk aversion to risk appetite. Plus, more easing is expected for the yen, and that is likely to contribute to weakness. Even though the yen saw some strength earlier, that has quickly been overcome by a bit of risk appetite, as well as the strong expectation […]

Read more February 5

February 52013

US Dollar Pares Some of Its Earlier Gains

US dollar is paring some of its earlier gains as risk appetite begins to make an appearance today. After some political uncertainty in Europe weighed on the euro, the 17-nation currency is now making progress against the US dollar, and the greenback’s performance against other majors is mixed. Concerns about the political situation in Europe weighed on the euro a little bit yesterday, as well as earlier today. US dollar got a boost on the risk […]

Read more February 5

February 52013

Ruble Drops with Crude Oil, Erases Losses Later

The Russian ruble advanced today, erasing its previous losses. Earlier, the currency declined as the worsening market sentiment hurt prices for crude oil, Russia’s major source of export revenue. Futures on crude oil lost 0.2 percent to $95.95 per barrel in New York today. Prices dropped as the traders’ mood was spoiled by the political turmoil in Europe. That drove investors away from the ruble, but the currency managed to recover even […]

Read more February 5

February 52013

AUD Weak After RBA Statement, Manages to Rise vs. JPY

The Australian dollar fell today after the Reserve Bank of Australia indicated in its policy statement that an interest rate cut is likely in the future. The currency rose a little against the Japanese yen as other news from Australia was positive for the most part. The RBA kept its main interest rate stable at 3 percent. Overall, the accompanying statement was mildly optimistic, saying that for global growth “the downside risks appear […]

Read more February 5

February 52013

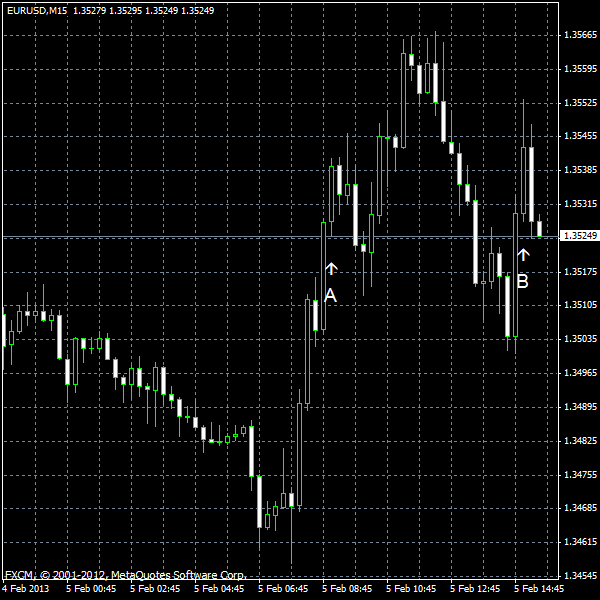

EUR/USD Rise on European PMI

EUR/USD rose today as the eurozone composite Purchasing Managers’ Index pleasantly surprised traders by rising, while no change was expected. (Event A on the chart.) Yesterday, the currency pair sank amid political turmoil in Spain and Italy. The reports from the United States were not particularly good, but were not terrible either. ISM services PMI rose 55.2% in January, matching forecasts exactly. The December growth was 56.1%. (Event […]

Read more