Today, it has come to my attention that I still had not blogged about one of the most important issues in Forex chart analysis â the validity of using the Open/Close values in daily and intraday charts. As you know, majority of FX traders use either candlestick or bar charts. Each bar and candlestick consists of only four values â Open, Close, High and Low. In candlestick pattern analysis, open and close levels are very important. For example, a doji pattern requires Close level to be the same as Open. Many expert advisors and indicators rely on open and close levels. For example, standard moving averages are applied to Close price.

The problem is that Open/Close levels do not mean much for D1 or lower timeframes in foreign exchange market. While daily Open/Close levels are very important in stock market, there is nothing special about daily Open/Close in Forex (except, maybe, Monday Open and Friday Close at GMT). It becomes obvious when you consider the fact that different traders operate in different timezones and actually look at bar charts with their own daily Open and Close levels. Moreover, as there is no global daily sessions in Forex, nothing special is happening at the end of a daily bar, neither at the beginning of the new one. Intraday timeframes give even less significance to Open/Close levels. The only factor that makes them valuable is that many traders look at the same timeframe and see the same picture.

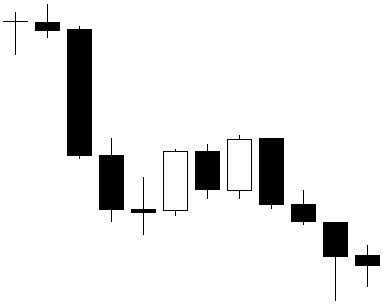

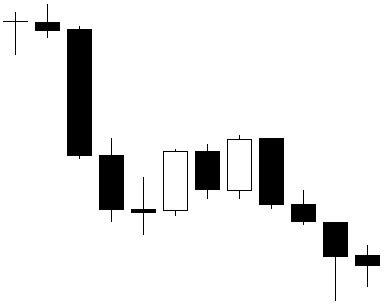

As seen on the example chart excerpt, Open level often mimics previous bar’s Close level except for occasional gaps.

While High/Low values may fluctuate similarly depending on the timezone, they are more meaningful as they show actual mathematical maximum or minimum for a period whereas Open and Close are just prices at some conventional but insignificant moments of time. That being said, Open/Close levels are not going anywhere and even though I am ware of their disadvantages I still use them in my trading. At the same time, I prefer to base my strategies on immediate price or High/Low instead of Open/Close where it is possible.

It is also worth noting that Open/Close levels are completely valid and are very important on weekly timeframe as Forex market is characterized by fairly well defined weekly trading sessions.

![]() Loading …

Loading …

If you have something to say about advantages or disadvantages of using High/Low values vs. Open/Close values in currency trading, please feel free to do so using the commentary form below.