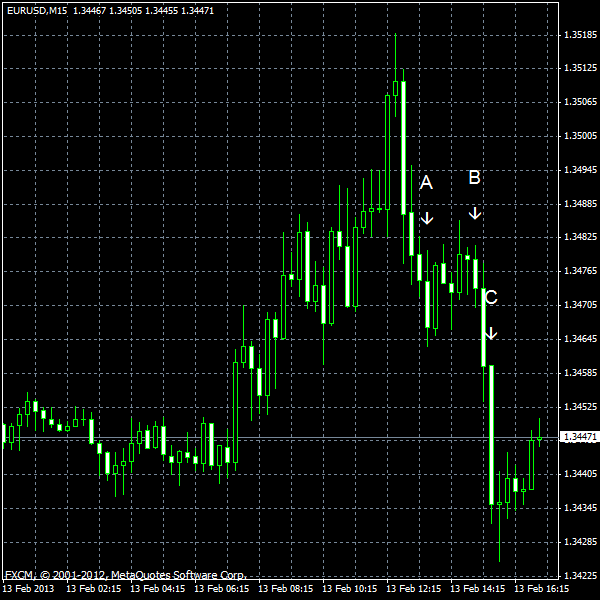

EUR/USD was rallying today, but erased gains as Portugal’s unemployment reached the highest level in a history after an introduction of the euro. Today’s data from the United States was not very impressive, but at least it was on a positive side. Yesterday’s federal budget balance made a nice surprise, demonstrating an unexpected surplus.

Retail sales grew 0.1% in January, matching forecasts exactly. The rate of growth was noticeably slower than the December’s 0.5%. (Event A on the chart.)

Export and import prices rose in January. Imports rose 0.6% (compared to expectations of 0.8%) following the 0.5% decline in December. Exports increased 0.3% last month after falling 0.1% in the month before. (Event A on the chart.)

Business inventories edged up 0.1% on a seasonally adjusted basis in December from November, when they rose 0.2%. The median estimate was 0.3%. (Event B on the chart.)

Crude oil inventories increased by 0.6 million barrels last week (less than was forecast — 2.4 million) and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 0.8 million barrels but remained in the upper limit of the average range. (Event C on the chart.)

Yesterday, a report on treasury budget deficit was released, showing a reading of -$2.9 billion in January (an unexpected surplus). A increase of deficit from $1.2 billion to $4.6 billion was expected by analysts. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.