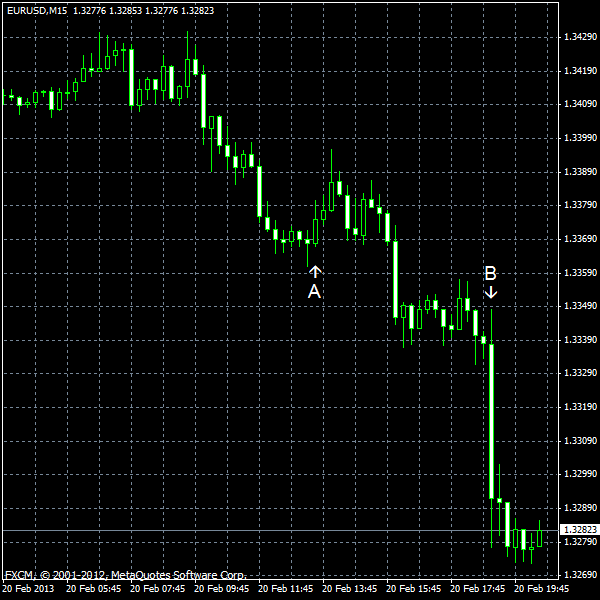

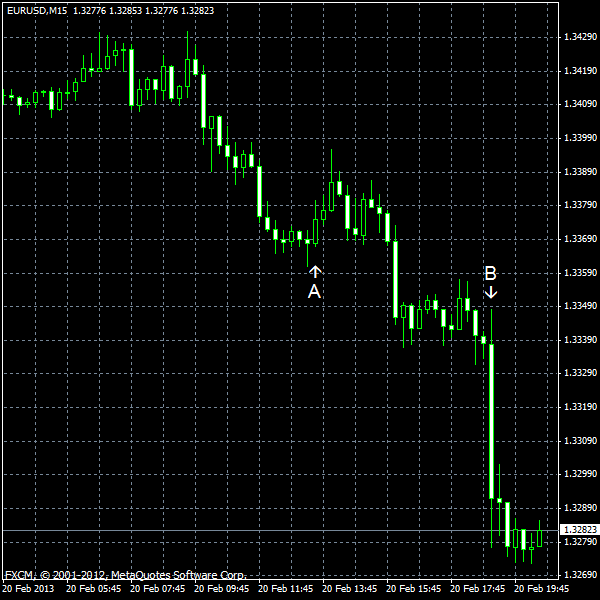

EUR/USD sank today after the minutes of the last Federal Reserve’s policy meeting were released. The minutes did not show anything new, but the currency pair extended its decline, which it was experiencing during today’s trading session. Other news from the United States was largely neutral and unlikely to affect the currencies in any noticeable manner.

PPI rose 0.2% in January on a seasonally adjusted basis. The increase was slightly smaller that the expected 0.3%. The index declined 0.2% in December. (Event A on the chart.)

Housing starts were at the seasonally adjusted rate of 890k in January, falling from the December’s 973k. A bit higher reading of 930k was expected by market participants. Building permits were at the seasonally adjusted rate of 925k last month, little changed from the previous month’s 909k and being in line with analysts’ forecasts. (Event A on the chart.)

The Federal Open Market Committee minutes did not reveal anything particularly new, but showed that some policy makers thought it would be prudent to vary pace of monthly asset purchases (event B on the chart):

Several participants emphasized that the Committee should be prepared to vary the pace of asset purchases, either in response to changes in the economic outlook or as its evaluation of the efficacy and costs of such purchases evolved.

If you have any comments on the recent EUR/USD action, please reply using the form below.