- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 21, 2013

February 21

February 212013

FX Market Returns to Risk-Off Mode, CAD Weakened

The Canadian dollar fell today against its US peer and the Japanese yen as risk appetite came off the markets and crude oil, as well as other commodities, declined. The currency gained on the euro. April futures for crude, the major Canada’s export, slipped to $92.63 per barrel in New York, the lowest price since January 7. The Standard & Poorâs 500 Index went down 0.9 percent. The S&P GSCI Index of 24 commodities […]

Read more February 21

February 212013

Brazilian Real Suffer from Worries About Global Growth

The Brazilian real dropped as worries about the global growth reduced chances that the nation’s central bank will perform an interest rate hike. Analysts estimated that the Brazilian economy grew just 1 percent in the last year. The Central Bank of Brazil slashed interest rates to the record low of 7.25 percent to stimulate growth. The bank is not likely to change the policy as macroeconomic indicators from various countries across the world, including […]

Read more February 21

February 212013

US Dollar Index Hits Three-Month High on Risk Aversion

The US dollar index reached a three-month high during the session today, thanks in large part to risk aversion. However, the latest minutes from the recent Federal Reserve meeting are also helping the greenback. Risk aversion is one of the stories today, thanks in large part to the latest economic data out of the eurozone. Also not helping the risk situation is the fact that unemployment claims in the United States rose again. With […]

Read more February 21

February 212013

Risk Aversion Causes Decline of Stocks & Commodities, Aussie Follows

The Australian dollar fell against the Japanese yen and touched the lowest level since October versus the US dollar today as Asian stocks declined. The Aussie rebounded versus the greenback but stayed weak against the Japanese currency. The MSCI Asia Pacific Index of equities dropped as much 1.6 percent. The Standard & Poorâs GSCI Spot Index of commodities fell 1.1 percent, reducing the appeal of commodity currencies, including AUD. The Forex market […]

Read more February 21

February 212013

Euro Drops as Recession Fears Resurface

Euro is heading lower today, dropping on worries that the eurozone recession might not be coming to an end. Thanks to the latest manufacturing survey, concerns about the economic state of the 17-nation currency region are on the rise. It’s not helping that uncertainty is emerging in other areas as well. Even though many of the fears regarding the eurozone have been assuaged with the idea that the worst is over, there are […]

Read more February 21

February 212013

US Data Does Not Support EUR/USD

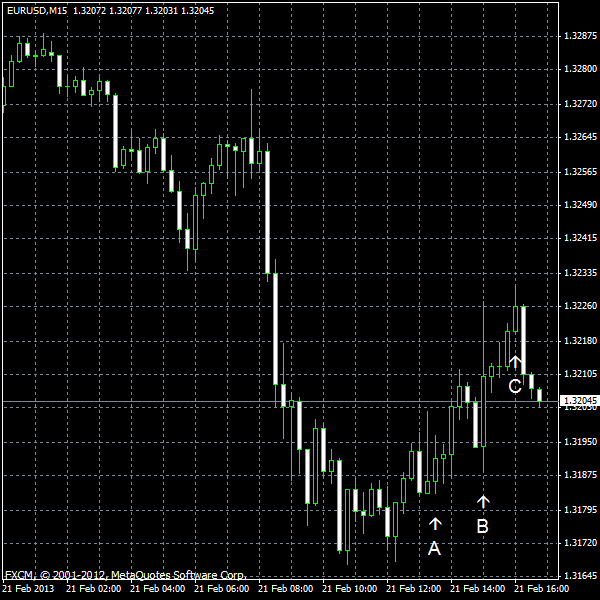

EUR/USD extended its decline for the second day today as most of the US macroeconomic data was worse than expected. The exception was the existing homes sales, which were a bit higher than forecasts, and the leading index. Traders interpreted the words in yesterday’s FOMC minutes about varying pace of asset purchases as a sign that some policy makers want to reduce stimulus. Such view supported the dollar. Initial jobless claims rose […]

Read more February 21

February 212013

Pound Maintains Losses After BoE Minutes

The Great Britain pound dropped after yesterday’s release of the Bank of England’s minutes and extended the decline today. The minutes suggested that some policy makers want more monetary stimulus. Governor Mervyn King and Paul Fisher joined David Miles in voting in favor of increasing the asset purchase program by £25 billion to £400 billion. Other members of the Monetary Policy Committee outvoted them though. Still, the growing number of central bankers preferring […]

Read more