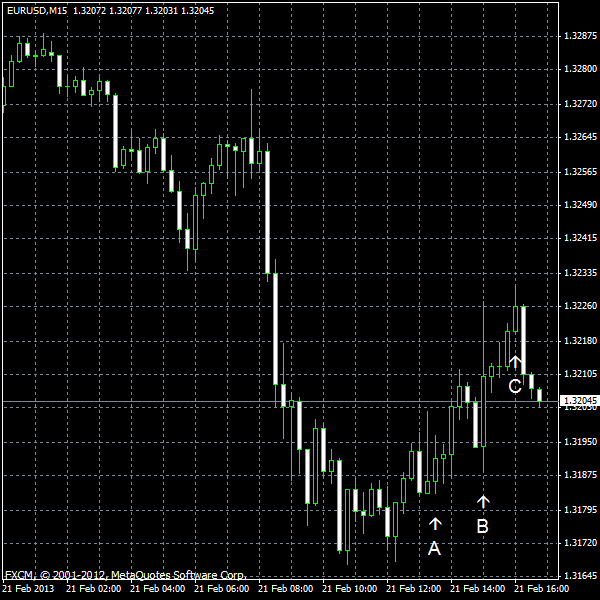

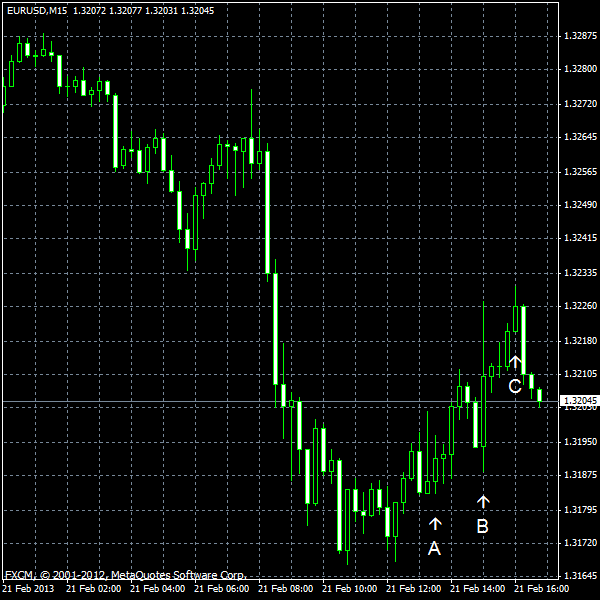

EUR/USD extended its decline for the second day today as most of the US macroeconomic data was worse than expected. The exception was the existing homes sales, which were a bit higher than forecasts, and the leading index. Traders interpreted the words in yesterday’s FOMC minutes about varying pace of asset purchases as a sign that some policy makers want to reduce stimulus. Such view supported the dollar.

Initial jobless claims rose from 342k to 362k last week on a seasonally adjusted basis. The median analysts’ estimate was 352k. (Event A on the chart.)

CPI was unchanged in January on a seasonally adjusted basis after posting no change in December. Market participants have hoped for an increase by 0.1%. (Event A on the chart.)

Existing home sales rose a little to the seasonally adjusted 4.92 million in January from 4.92 million in December (revised from 394k), while experts have expected a small decrease to 4.89 million. The report noted that there were more buyers than sellers, creating a shortage of housing inventory. (Event B on the chart.)

Philadelphia Fed manufacturing index unexpectedly slumped from -5.8 in January to -12.5 in February. Traders have anticipated an increase to 1.1. (Event B on the chart.)

Leading indicators rose 0.2% in January, matching forecasts and “pointing to a slow but continued expansion in economic activity in the near term”. The December increase was 0.5%. (Event B on the chart.)

Crude oil inventories increased by 4.1 million barrels last week from the previous week, compared to the expected 1.9 million, and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 2.9 million barrels but remained in the middle of the average range. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.