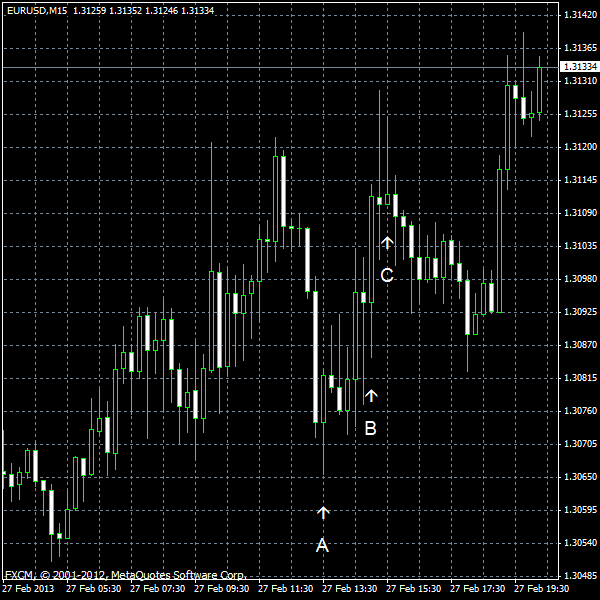

EUR/USD advanced today as Italy reached the maximum target at its debt auction, suggesting that the inconclusive election was not completely disastrous for the country. Federal Reserve Chairman Ben Bernanke testified yesterday and today, saying that quantitative easing does more good than harm and should be maintained. Such comments added to risk appetite of Forex traders. As for the US economic data, the housing market continued to show remarkable performance, while durable goods orders tumbled more than was expected.

Durable goods orders slumped as much as 5.2% in January compared to analysts expectations of a 4.8% drop. The December increase was revised from 4.6% to 4.3%. (Event A on the chart.)

Pending home sales jumped 4.5% in January, beating market expectations (1.7%) by a large margin. The December drop was significantly revised from 4.3% to 1.9%. (Event B on the chart.)

Crude oil inventories increased by 1.1 million barrels (the median estimate was 2.4 million) last week and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.9 million barrels but remained in the upper limit of the average range. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.