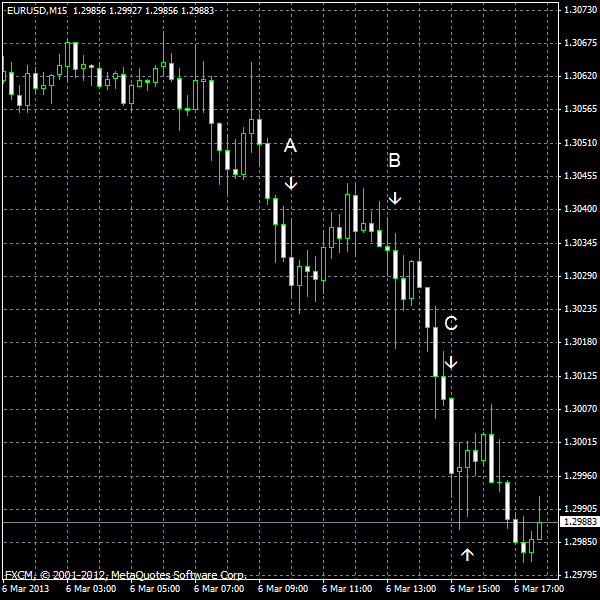

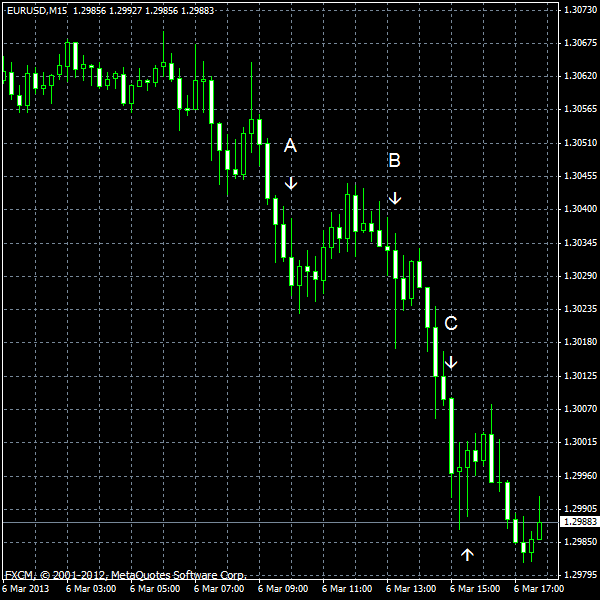

The market sentiment was supportive for risky currencies today, but it did not help the euro that fell ahead of tomorrow’s European Central Bank meeting. It is not likely that the bank will change its monetary policy tomorrow, but market participants think that ECB President Mario Draghi may signal about cutting interest rates later this year. The eurozone economy contracted 0.6% in the fourth quarter of 2012, unrevised from the preliminary estimate. (Event A on the chart.)

ADP employment showed robust growth, jumping by 198k in February from January, beating traders’ expectations of 172k. And that was not all the good news: The January increase was revised from 192k to 215k. (Event B on the chart.)

Factory orders dropped 2.0% in January, in line with forecasts of a 2.2% drop. The December advance was revised negatively from 1.8% to 1.3%. (Event C on the chart.)

Crude oil inventories increased by 3.8 million barrels last week from the previous week (the forecast was 0.9 million), while total motor gasoline inventories decreased by 0.6 million barrels. (Event D on the chart.)

Yesterday, a report on ISM services PMI was released, showing an increase from 55.2% in January to 56.0% in February. The projected figure was 55.0. (Not show on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.