- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 11, 2013

March 11

March 112013

Indian Rupee Falls on Concerns About Current Account Shortage

The Indian rupee fell today on concerns that a decrease of foreign capital inflows will lead to widening of the country’s current account deficit, which is already at the record level. Market participants are concerned that the gap, which on an annual basis was at the record 4.2 percent of gross domestic product a year ago, may climb much higher this year in case inflows of foreign capital dry up. Global funds added […]

Read more March 11

March 112013

Aussie Weakened by Chinese Industrial Production, Losses Limited

The Australian dollar fell against its US counterpart as China’s industrial production demonstrated the slowest start of a year since 2009. The Aussie almost erased its gains versus the greenback as of now and advanced against the Japanese yen. Chinese industrial output increase 9.9 percent in the first two months from a year ago, according to the National Bureau of Statistics. Analysts have hoped for an increased by 10.4 percent. The Australian currency dipped on this report, […]

Read more March 11

March 112013

Loonie Gets Boost from Jobs Report

Better than expected employment data is helping the Canadian dollar today, sending the loonie higher against its major counterparts. The surprise economic data is boosting Canadian dollar, and providing hope that economic weakness will not persist. Canada added a surprising 50,700 jobs to the economy in February, more than double what some analysts were expecting. On top of that, according to Statistics Canada, industrial companies used […]

Read more March 11

March 112013

UK Pound Struggles on Outlook

The UK pound outlook continues to be a sore point. Outlook is weaker for the sterling, with continued economic troubles predicted, and more stimulus expected. Just about every aspect of the UK economy is showing deterioration right now. Growth is expected to remain sluggish, and the Bank of England is expected to continue stimulus efforts. While the asset buying program remains unchanged for now, many Forex traders and analysts expected more […]

Read more March 11

March 112013

When Will Fed Start Raising Interest Rates?

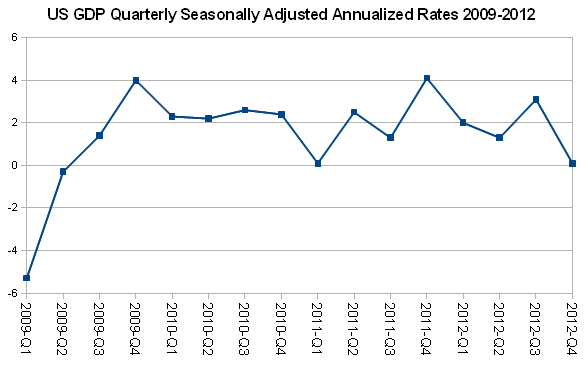

The current Quantitative Easing policy conducted by the US Federal Reserve consists of two parts — asset-purchase program (where Fed buys mortgage-backed securities and long-term US Treasury notes) and exceptionally low interest rates (a range between 0% and 0.25%). As becomes evident from looking at the US GDP and employment numbers progression since mid-2009, Bernanke‘s strategy works quite well: But what is important to many currency traders is when […]

Read more