The current Quantitative Easing policy conducted by the US Federal Reserve consists of two parts —

But what is important to many currency traders is when the Federal Open Markets Committee (FOMC) will start raising interest rate, which logically should lead to a considerable rally of the US dollar against many other major currencies.

Since its meeting in August 2011, FOMC began making projections for its expected end of the “exceptionally low levels” for the federal funds rate. Until the end of 2011, the Fed continued to expect its policy to last “at least through mid-2013.”

Since January 2012 meeting, FOMC has been projecting the lifetime of its policy to “at least through late 2014.”

October 2012 meeting has changed that to “at least through mid-2015.”

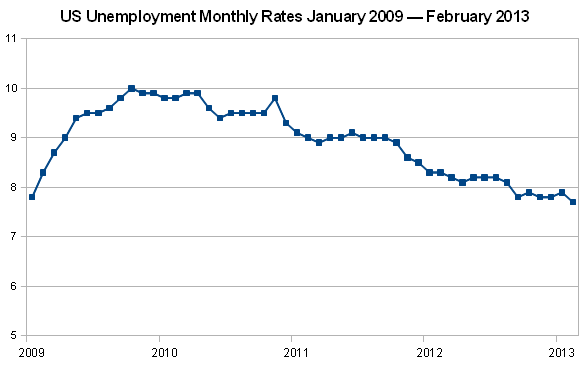

Starting with December 2012 meeting, the formula has changed dramatically. The Federal Reserve is no longer targeting a time period. Instead, they target a specific unemployment rate — it should be at 6.5% or lower. Coincidentally, their latest projections show that such rate will probably be reached in 2015.

Personally, I believe that the US interest rates will be increased by the end of 2014 and the dollar rally will start long before that time. My reasoning for a closer end of the current Fed’s policy is a possible boost of inflation and an increased growth in employment (mostly due to “repatriation” of the job places). And what do you think?

When will Federal Reserve discontinue its Quantitative Easing program?

- 2014 (56%, 15 Votes)

- 2013 (15%, 4 Votes)

- 2016 (15%, 4 Votes)

- 2015 (11%, 3 Votes)

- Never (4%, 1 Votes)

- 2017 or later (0%, 0 Votes)

Total Voters: 27

![]() Loading …

Loading …

The post will expire on December 16, 2013 — just before the last FOMC meeting this year.

If you have something to tell other traders about the Federal Reserve and its loose monetary policy, please feel free to do so using the commentary form below.