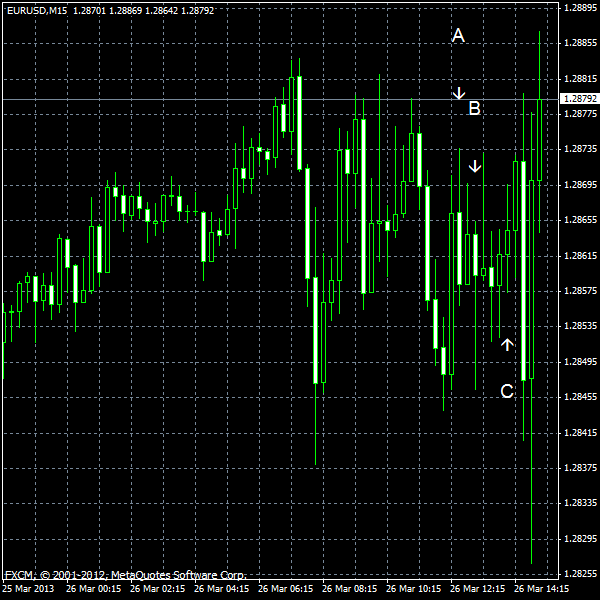

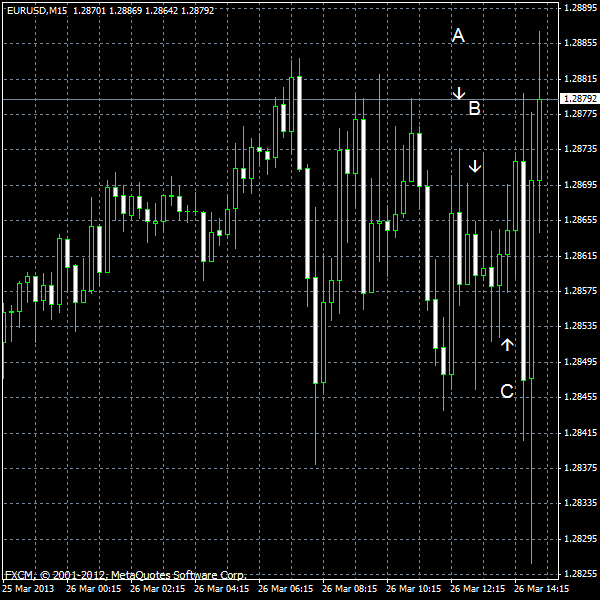

EUR/USD extended its losses for the second session today after Cyprus reached an agreement with the European Union to receive a bailout. The Forex market shifted to a risk positive mode initially after the deal was announced yesterday. Traders quickly lost their optimism after they realized that the terms of the agreement involved losses for private sector. There were even rumors that some EU officials proposed the deal as a model for saving other indebted countries. Today’s reports from the United States were mixed and are overshadowed by the situation in Cyprus.

Durable goods orders jumped 5.7% in February, beating analysts’ expectations of 3.9%. The January figure was revised positively from -5.2.% to -4.9%. (Event A on the chart.)

S&P/

Richmond Fed manufacturing index edged down from 6 in February to 3 in March. This was not a pleasant surprise for traders, who expected an increase to 8. Still, manufacturers were looking into the future with optimism. (Event C on the chart.)

Consumer confidence was at 59.7 in March, notably below the forecast value of 67.9. Moreover, the February estimate was revised from 69.6 to 68.0. (Event C on the chart.)

New home sales were at the seasonally adjusted annual rate of 411k in February. The data frustrated analysts who have predicted the sales to be at 426k. The January reading received a negative revision from 437k to 431k. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.