- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 6, 2014

October 6

October 62014

Euro Runs to Upside, Ignoring Negative Fundamentals

The euro climbed today even though the European macroeconomic indicators were rather unfavorable. The broad-based weakness of the US dollar was the major reason for the rally of the shared 18-nation currency. Today’s macroeconomic indicators were very negative, adding to evidence of Europe’s economic struggle. German factory orders contracted 5.7 percent in August. The Markit Eurozone Retail Purchasing Managers’ Index fell from 45.8 in August to 44.8 in September, demonstrating the sharpest decline […]

Read more October 6

October 62014

CAD – Another Currency to Rally vs. USD

The Canadian dollar was yet another currency to rally against the US dollar today. Positive macroeconomic data helped the currency to rally against the Japanese yen too, but the loonie was unable to gain on the euro, trading near the opening level versus the shared 18-nation currency. The Canadian dollar demonstrated big losses versus the greenback on Friday but managed to log even bigger gains today. The currency also rallied for the second trading […]

Read more October 6

October 62014

Aussie Joins Rally Against Greenback

The Australian dollar joined other most traded currencies in a rally against the US dollar today, while positive economic data from Australia allowed the Aussie to rise against its other major counterparts as well. The greenback halted its rally, allowing other currencies to log gains, and the Australian dollar joined the trend. Domestic macroeconomic indicators added to the bullish momentum of Australia’s currency. The Melbourne Institute Monthly Inflation Gauge rose 0.1 […]

Read more October 6

October 62014

USD/CHF Retreats from Highest Since July 2013

The Swiss franc gained on the US dollar today, bouncing from the lowest level since July 2013, as the greenback halted its rally that was fueled by non-farm payrolls released on Friday. The Swissie also managed to log gains against its other major counterparts. The dollar paused its rally, most likely due to profit-taking, and the Swiss currency took its chance to benefit from this. Yet today’s strength of the Swissie does […]

Read more October 6

October 62014

US Dollar Consolidates After Wild End to the Week

The latest payrolls data out of the United States prompted a surge in the greenback, and right now the US dollar appears to be consolidating after its gains. Even though the dollar index is weaker today, there are many that expect more dollar strength to come. The latest NFP data, for September, showed an increase of jobs to the economy, and the unemployment rate dropping to below 6 per cent for the first time in six years. The news […]

Read more October 6

October 62014

Pound Struggles a Bit on Economic Data

UK pound is struggling a bit against some of its major counterparts today, thanks largely to recent economic data. While the pound is higher against the dollar right now, it is down against the euro and the yen. Last week ended with a lot of economic data for Forex traders and others to process. One of the bits of data was the fact that September PMI data for the United Kingdom was below expectations. […]

Read more2014

Forex Brokers Update — October 6th, 2014

No new companies this week, but there are some updates to the listed brokers: Spread Co removed Saturn Trader platform. Real-Forex and Univell Broker started offering demo accounts with MetaTrader 4 platform. AAAFx stopped supporting MT4 platform. SunbirdFX no longer offers ActTrader demo accounts, removed ZuluTrade and Currenex platforms. Ajax Financial no longer offers Avalon FX Pro platform. Profiforex […]

Read more October 6

October 62014

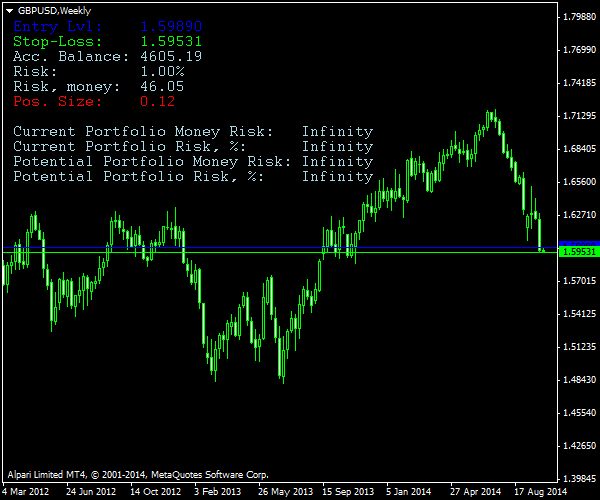

Track Portfolio Risk with Position Size Calculator

You can now track your whole portfolio risk with the Position Size Calculator indicator for MetaTrader. The indicator now calculates the potential loss of all the open positions and pending orders across the account and shows it to the trader. Traders can control whether to count pending orders or not and whether to count orders and positions without stop-loss or not. Four values are calculated: current portfolio risk in account’s currency, the same value […]

Read more