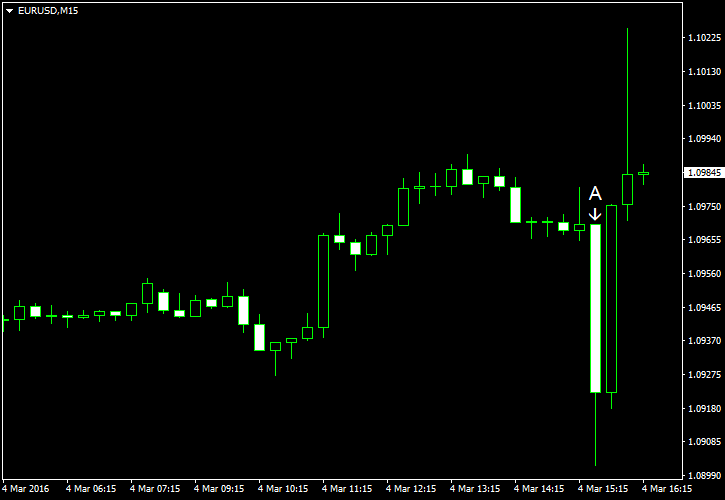

EUR/USD dipped after the release of solid US nonfarm payrolls as to be expected. What was unexpected was the quick and strong bounce of the currency pair immediately after the dip. Whatever was the reason for such behavior, the dollar showed the similar performance in other currency pairs — rallying after the release of employment data but sinking quickly afterwards.

Nonfarm payrolls demonstrated strong growth by 242k in February. The growth has exceeded both market expectations of 195k and the previous month’s gain of 172k (revised up from 151k). Unemployment rate provided no surprises, staying at 4.9%. Average hourly earnings were disappointing, falling 0.1% instead of rising 0.2% as it has been predicted. Wage inflation was at 0.5% in January. (Event A on the chart.)

Continuing the theme of disappointment, trade balance deficit was at $45.7 billion in January, up from $44.7 billion in December (revised from $43.4 billion), whereas forecasters had promised a notably smaller shortage of $43.8 billion. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.