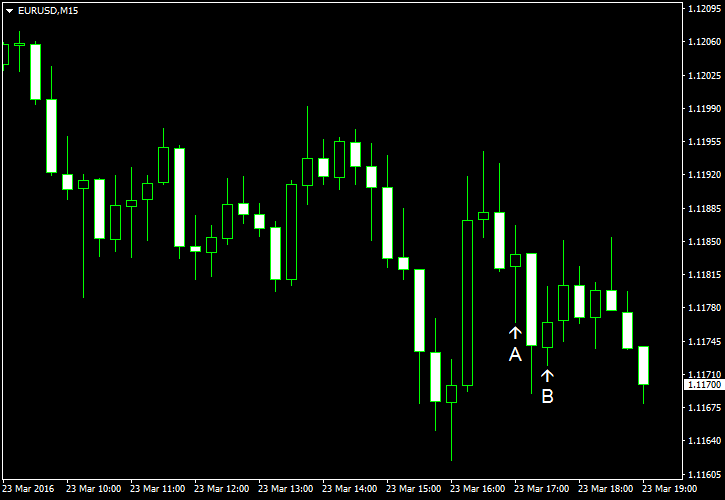

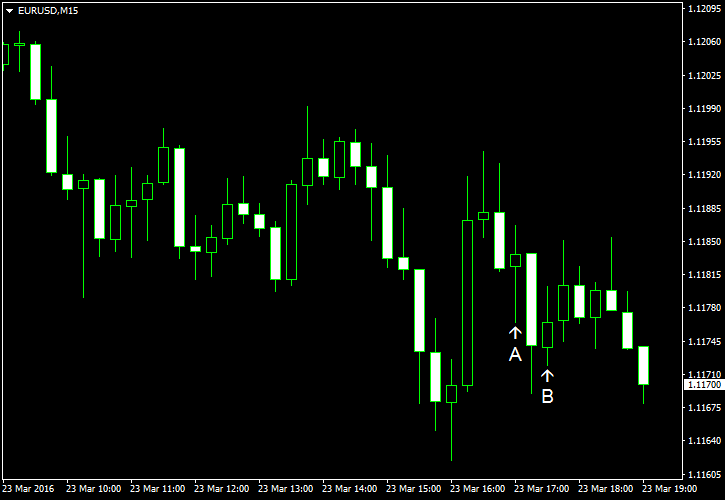

EUR/USD extended its declined for the fourth consecutive session today. Markets are recovering after the impact of yesterday’s bombing in Brussels and feel less need for safe haven. Yet the dollar was still gaining on the euro as various regional Fed presidents were talking about possibility of an interest rate hike as soon as the next month.

New home sales were at the seasonally adjusted level of 512k in February, matching forecasts exactly. The January rate was revised from 494k to 502k. (Event A on the chart.)

US crude oil inventories swelled by 9.4 million last week, staying at a record level. The increase was far bigger than the predicted 2.5 million gain and the previous week’s growth of 1.3 million. Total motor gasoline inventories decreased 4.6 million barrels last week but remained well above the upper limit of the average range. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.