- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 29, 2016

March 29

March 292016

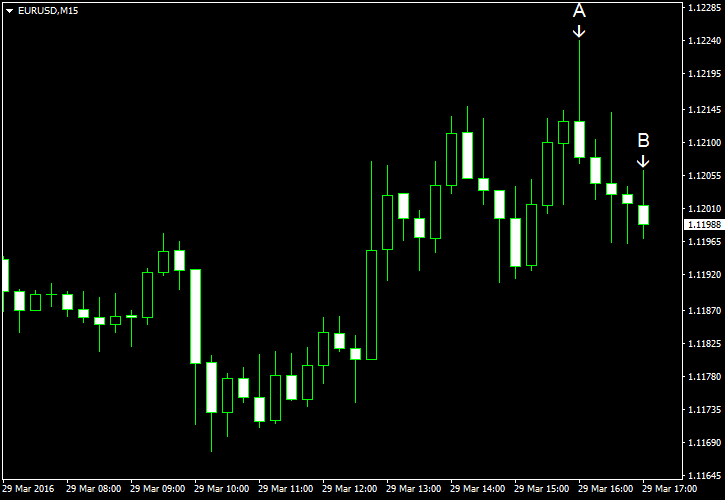

EUR/USD Struggles to Extend Rally Ahead of Yellen’s Speech

EUR/USD was attempting to extend yesterday’s rally but had troubles with doing so as economic data released today from the United States was rather good. Now, traders turned their attention to the upcoming speech of Federal Reserve’s chief Janet Yellen as her comments may change the outlook for the dollar. S&P/Case-Shiller home price index rose 5.7% in January (year-on-year), exactly as forecasters had predicted and almost at the same rate […]

Read more March 29

March 292016

CAD Rallies vs. USD, Less Successful Against Other Majors

The Canadian dollar rallied against its US counterpart after the dovish comments from the Federal Reserve’s head sent the greenback tumbling. The loonie had less success against its other major rivals due to the crash of crude oil prices. The speech from Janet Yellen basically squashed hopes for an April interest rate hike and made some analysts lower the outlook for rate increases this year from two to just one […]

Read more March 29

March 292016

Euro Rallies vs. Dollar & Yen, Flat vs. Pound

The euro rallied together with other currencies against the US dollar after Janet Yellen, Chairperson of the Federal Reserve, signaled that monetary tightening would be cautious and gradual. The currency also rose versus the Japanese yen but remained flat against the Great Britain pound. Last week, Fed officials were talking about the possibility of an April interest rate hike. Yet that possibility all but evaporated after […]

Read more March 29

March 292016

China Sets Higher Midpoint for Yuan Against Dollar

China has set a higher midpoint for the yuan in its peg to the US dollar today. Greenback has strengthened slightly against the yuan since the change, but this still marks an effort for a stronger yuan as the greenback heads a little lower. Short-term downward pressure on the yuan is being somewhat relieved today by the adjustment Chinese policymakers have made in the midpoint for the yuan against the US dollar. The midpoint for the yuan (also called the renminbi) was […]

Read more March 29

March 292016

Soft Data and Rate Hike Expectations Send Dollar Lower

US dollar index is lower today thanks in large part to the fact that rates hike expectations are changing. Softer data reports are weighing on the greenback and sending it lower against its major counterparts. Some analysts and traders have been holding out hope that the Federal Reserve would decide to hike rates in April. However, after the latest round of data, it appears that many will have […]

Read more March 29

March 292016

Yen Weaker After Release of Mixed Economic Indicators

The Japanese yen was weaker today after the release of mixed economic data from Japan. On the positive side, household spending rose 1.2% in February from a year ago while analysts had predicted a drop by 1.8%. On the negative side, the unemployment rate rose unexpectedly from 3.2% to 3.3% last month. Retail sales were up 0.5% in February 2016 from February 2015, about three times below forecasts. USD/JPY […]

Read more