EUR/USD extended its yesterday’s rally that was caused by the passiveness of the Federal Reserve. Today’s data was not helpful to the US dollar either as both housing data and the leading indicators missed expectations. Only unemployment claims were better than forecasts.

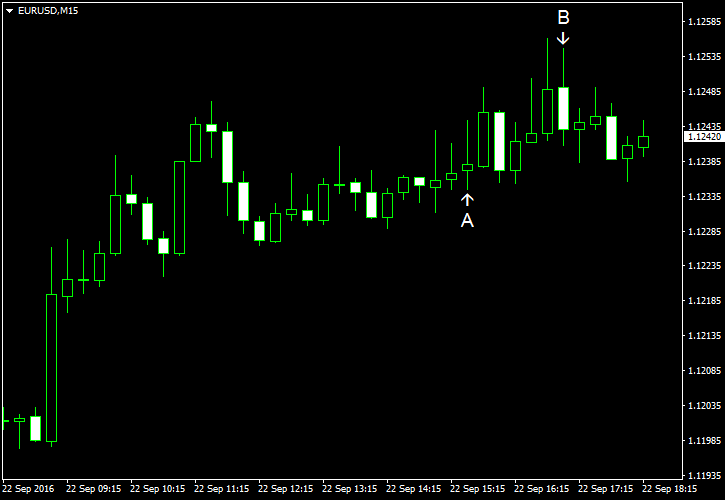

Initial jobless claims fell from 260k to 252k last week while analysts had expected them to stay almost unchanged at 261k. (Event A on the chart.)

Existing home sales were at the seasonally adjusted annual rate of 5.33 million in August — below the forecast value of 5.45 million and the downwardly revised 5.38 million in July. (Event B on the chart.)

Leading indicators fell 0.2% in August even though experts had promised them to stay unchanged. The July figure got a small positive revision from 0.4% growth to 0.5%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.