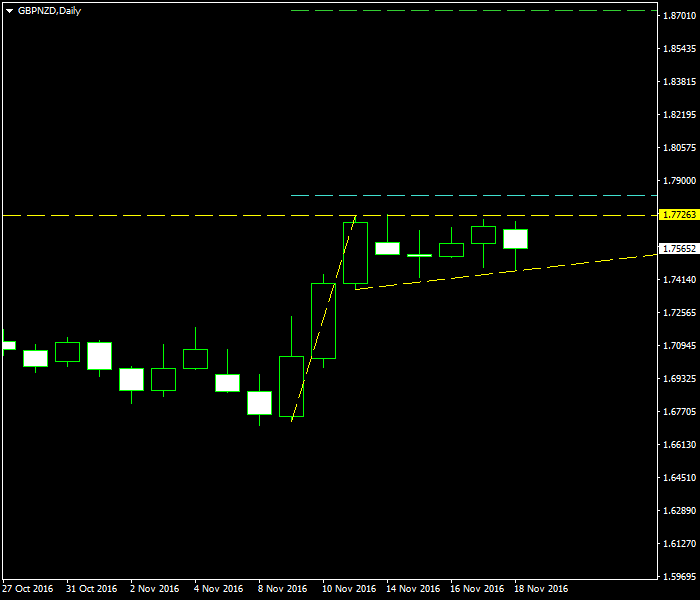

The US Presidential elections followed a few days after a rather bullish factor for the UK pound — the High Court decision that the Government will need to consult the Parliament on the matter of Brexit. Both have triggered the rally in the British pound. At the same time, the New Zealand dollar has been weakened by the country’s central bank’s decision to lower the interest rates. This combination has created the current situation on daily GBP/NZD chart — a bullish pennant pattern ready to break out to the upside. It threatens to ruin my GBP/NZD carry trade but offers a trading opportunity of its own.

The pole and the borders of the pennant part are show with the yellow lines on the chart below. The cyan line is my potential entry level should the breakout occur. It is placed at 10% of the pole’s height above the upper border of the pattern. The green line will be my

I have built this chart using the ChannelPattern script. You can download my MetaTrader 4 chart template for this GBP/NZD pattern. You can trade it using my free Chart Pattern Helper EA.

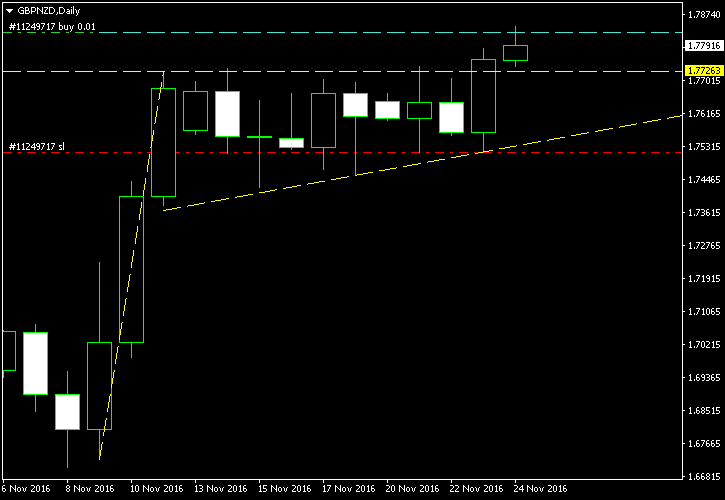

Update 2016-11-25 23:09 GMT: The breakout triggered a long trade early in the morning today. The entry point was at 1.78266 with SL at 1.75177 and TP at 1.87291. The breakout bar does not look strong now:

Update 2016-11-29:

If you have any questions or comments regarding this bullish pennant on GBP/NZD chart, please feel free to submit them via the form below.