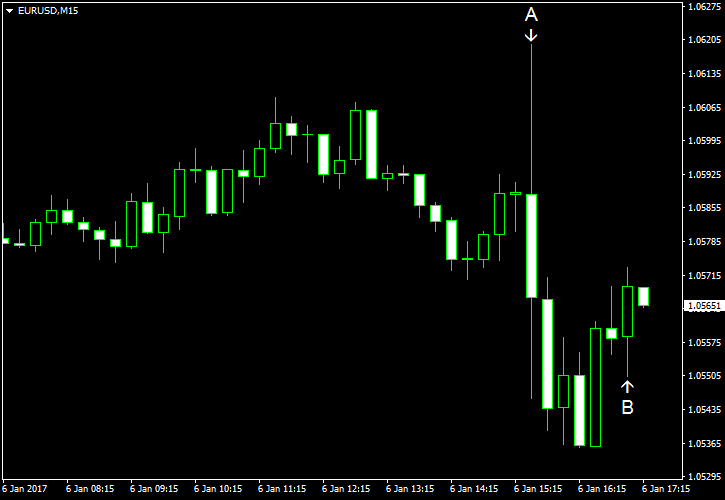

EUR/USD declined today even though the fundamental indicators that came out from the United States were rather mixed. Traders preferred to buy the dollar despite the fact that the news brought nothing positive about the US economy.

Trade balance deficit widened from October’s reading of $42.6 billion to $45.2 billion in November. The result was not far from the median forecast of $45.5 billion. (Event A on the chart.)

Nonfarm payrolls gained 156k in December after increasing by 204k in November. The anticipated growth had been at 175k. Unemployment rate went up from 4.6% to 4.7% as expected. Average hourly earnings rose by 0.4% vs. 0.1% drop a month earlier. Market participants had expected a gain by 0.3%. (Event A on the chart.)

US factory orders declined by 2.4% in November — almost as expected (2.3% drop). October’s report showed a growth by 2.7% for factory orders. (Event B on the chart.)

The fall of the durable goods orders in November was revised from 4.6% to 4.5%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.