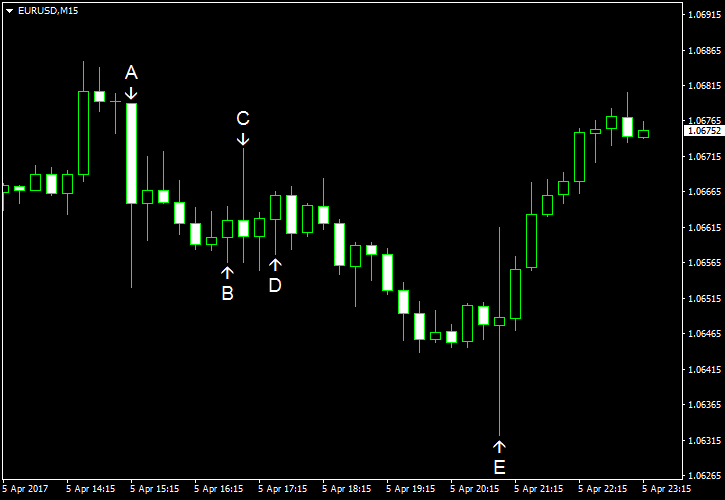

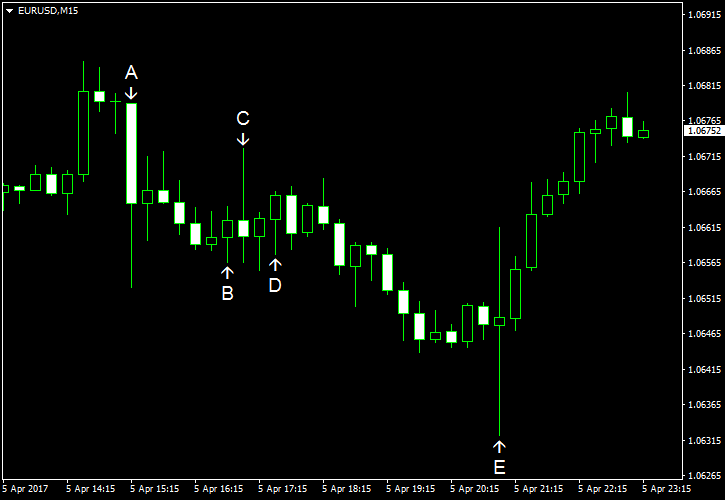

EUR/USD was falling during the Wednesday’s trading session but halted its decline after the Federal Open Market Committee released minutes of its latest policy meeting. The currency pair swung back and forth wildly immediately after the release but decided to go up in the end. As for other news from the United States, the employment market looked strong while the service sector disappointed.

ADP employment grew by 263k on March, much more than analysts had predicted (184k). The previous month’s increase was revised from amazing 298k to still impressive 245k. (Event A on the chart.)

Markit services PMI fell from 53.8 in February to 52.8 in March, the lowest level in six months, according to the final estimate. It was below both the preliminary reading of 52.9 and the median forecast of 53.1. (Event B on the chart.)

ISM services PMI dropped from 57.6% in February to 55.2% in March, below the consensus forecast of 57.0%. (Event C on the chart.)

Crude oil inventories increased by 1.6 million barrels last week instead of falling by 0.1 million as analysts had predicted. The stockpiles rose by 0.9 million the week before. Total motor gasoline inventories decreased by 0.6 million barrels last week but remained in the upper half of the average range for this time of year. (Event D on the chart.)

The minutes of the latest FOMC policy meeting were released today. Markets considered them to be rather hawkish, in particular the mention of reduction of the balance sheet size. (Event E on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.