- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: April 6, 2017

April 6

April 62017

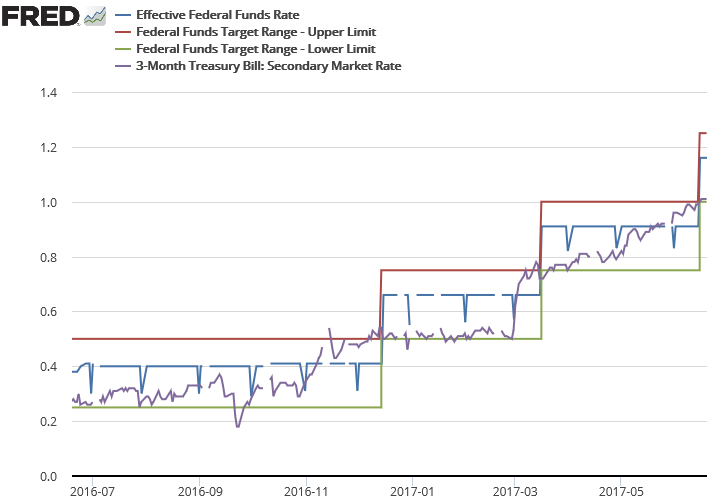

How Fed Funds Rate Works (and Why Forex Traders Should Care)

It is not the aim of this post to explain how the central bank interest rates work. Its aim is to show how the current federal funds rate operation differs from its pre-crisis model and how it is important to Forex traders. Before 2008 Contents 1 Before 2008 2 Our times 2.1 Ceiling rate 2.2 Floor rate 2.3 Efficiency 3 Relation to Forex When […]

Read more April 6

April 62017

Canadian Dollar Recovers from Early Losses Despite Negative Housing Data

The Canadian dollar rose against its US counterpart and the euro on Thursday, after recovering from the losses it had earlier today. The loonie appeared unaffected by fresh housing data that revealed a smaller value of building permits in February. Statistics Canada, the nationâs official statistical office, released a report that stated that building permits issued in February totaled $7.5 billion, which is 2.5% lower than Januaryâs level. […]

Read more April 6

April 62017

Canadian Dollar Recovers from Early Losses Despite Negative Housing Data

The Canadian dollar rose against its US counterpart and the euro on Thursday, after recovering from the losses it had earlier today. The loonie appeared unaffected by fresh housing data that revealed a smaller value of building permits in February. Statistics Canada, the nationâs official statistical office, released a report that stated that building permits issued in February totaled $7.5 billion, which is 2.5% lower than Januaryâs level. […]

Read more April 6

April 62017

EUR/USD Declines on Dovish ECB and the Release of US Jobless Claims Data

The EUR/USD currency pair has been on a major decline during today’s session following dovish comments from Mario Draghi and the positive US jobless claims data. The release of the minutes of the European Central Bank‘s March meeting also indicated that the bank would be maintaining its forward guidance into the future. The currency pair lost close to 20 points after the release of the US jobless claims data to extend its bearish […]

Read more April 6

April 62017

EUR/USD Declines on Dovish ECB and the Release of US Jobless Claims Data

The EUR/USD currency pair has been on a major decline during today’s session following dovish comments from Mario Draghi and the positive US jobless claims data. The release of the minutes of the European Central Bank‘s March meeting also indicated that the bank would be maintaining its forward guidance into the future. The currency pair lost close to 20 points after the release of the US jobless claims data to extend its bearish […]

Read more April 6

April 62017

Australian Dollar Drops on Chinese Services PMI, Manages to Bounce

The Australian dollar slumped after today’s data showed that growth of China’s services sector slowed unexpectedly. Yet by now, the currency managed to rebound and is trading near the opening level currently. The Caixin China Services PMI dropped from 52.6 in February to 52.1 in March instead of rising to 53.2 as analysts. China is Australia’s biggest trading partner, therefore data from the Asian country tends to influence performance of the Aussie strongly. […]

Read more April 6

April 62017

Australian Dollar Drops on Chinese Services PMI, Manages to Bounce

The Australian dollar slumped after today’s data showed that growth of China’s services sector slowed unexpectedly. Yet by now, the currency managed to rebound and is trading near the opening level currently. The Caixin China Services PMI dropped from 52.6 in February to 52.1 in March instead of rising to 53.2 as analysts. China is Australia’s biggest trading partner, therefore data from the Asian country tends to influence performance of the Aussie strongly. […]

Read more April 6

April 62017

Czech Koruna Soars After Central Bank Removes Cap

The Czech koruna soared today after the nation’s central bank removed the cap on the currency against the euro (CZK27 per euro). The Czech National Bank announced today: At its extraordinary monetary policy meeting today, the CNB Bank Board decided to end the CNBâs exchange rate commitment. The bank warned that it will take measures in case of excessive volatility on the currency markets: The CNB stands ready to use its […]

Read more April 6

April 62017

Czech Koruna Soars After Central Bank Removes Cap

The Czech koruna soared today after the nation’s central bank removed the cap on the currency against the euro (CZK27 per euro). The Czech National Bank announced today: At its extraordinary monetary policy meeting today, the CNB Bank Board decided to end the CNBâs exchange rate commitment. The bank warned that it will take measures in case of excessive volatility on the currency markets: The CNB stands ready to use its […]

Read more