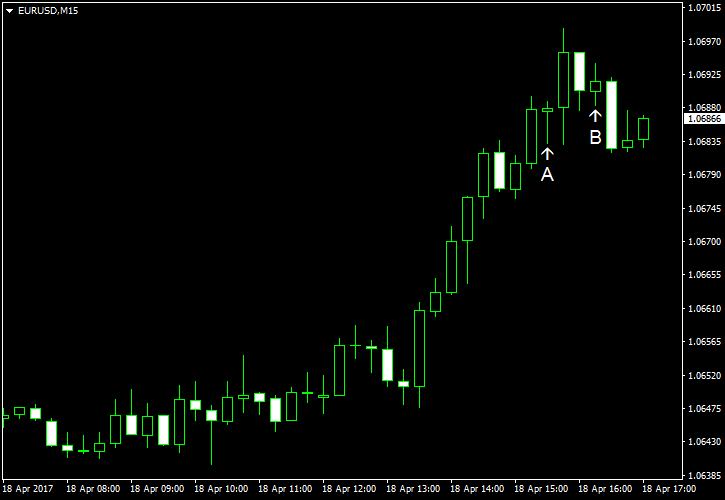

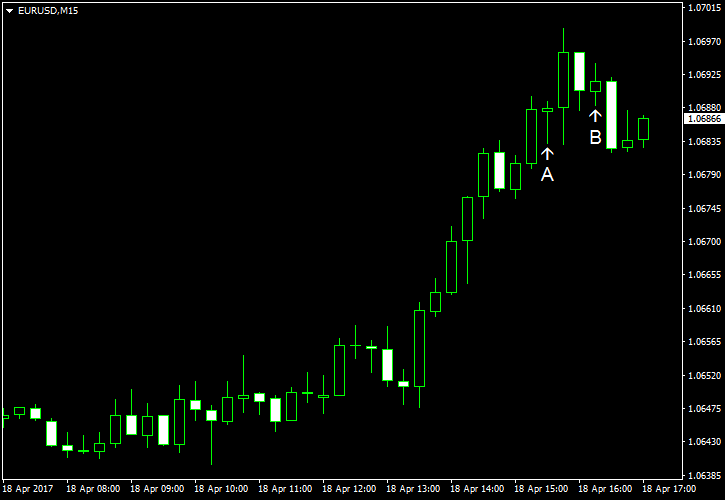

EUR/USD rallied today as US macroeconomic reports failed to meet expectations. Not all of them were bad, but that did not prevent the currency pair from rising.

Housing starts were at the seasonally adjusted annual rate of 1.22 million in March. That is below the medium forecast of 1.25 million and the previous month’s rate of 1.30 million. Building permits were at the seasonally adjusted annual rate of 1.26 million, close to the forecast of 1.25 million and above the February value of 1.22 million. (Event A on the chart.)

Industrial production increased 0.5% in March, exactly as analysts had predicted, after rising 0.1% in February. Capacity utilization increased from 75.4% to 76.1% but failed to meet market expectations of 76.3%. (Event B on the chart.)

Yesterday, a couple of reports were released. (Not shown on the chart.)

NY Empire State Index slumped from 16.4 to 5.2 in April, far below the reading of 15.2 predicted by analysts.

Net foreign purchases were at $53.4 billion in February. That is above the $12.4 billion figure promised by economists and the January reading of $5.9 billion.

If you have any comments on the recent EUR/USD action, please reply using the form below.