EUR/USD dropped today after the European Central Bank made no changes to its

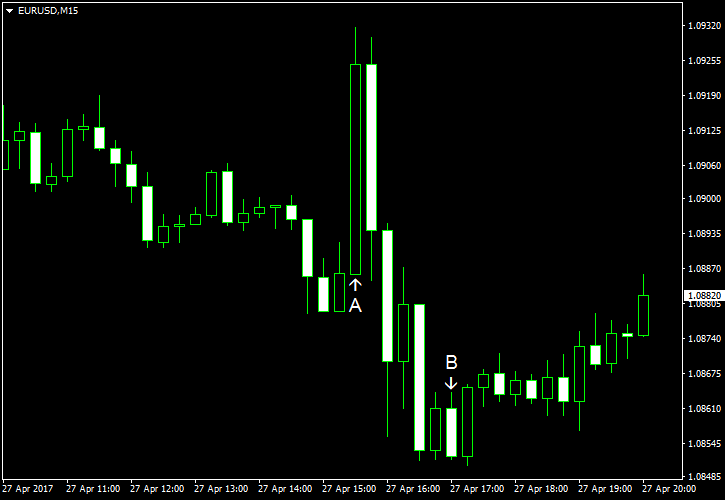

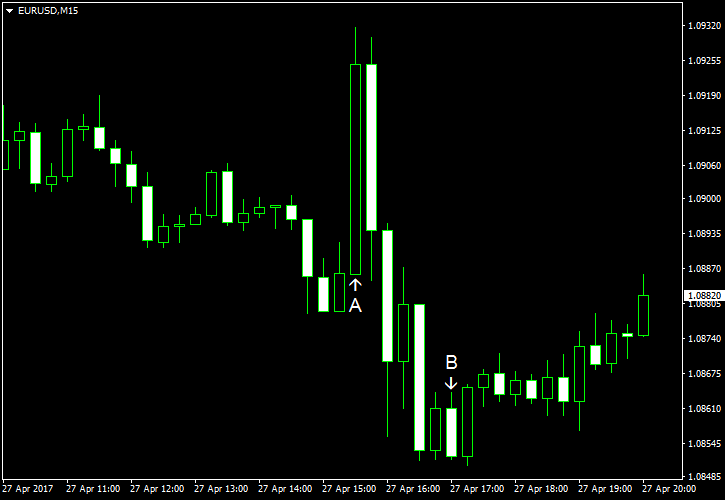

Initial jobless claims rose to 257k last week from the previous week’s revised value of 243k. That was a surprise to analysts as they had expected a small drop to 241k. (Event A on the chart.)

Durable goods orders rose 0.7% in March. That is compared to the forecast growth of 1.5% and the previous month’s rate of 1.8%. (Event A on the chart.)

Pending home sales fell 0.8% in March from February, more than analysts had predicted (0.6%). The report explained the decline by sparse inventories, while buyers were actually very active. The sales were up as much as 5.5% in February. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.