- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 31, 2017

May 31

May 312017

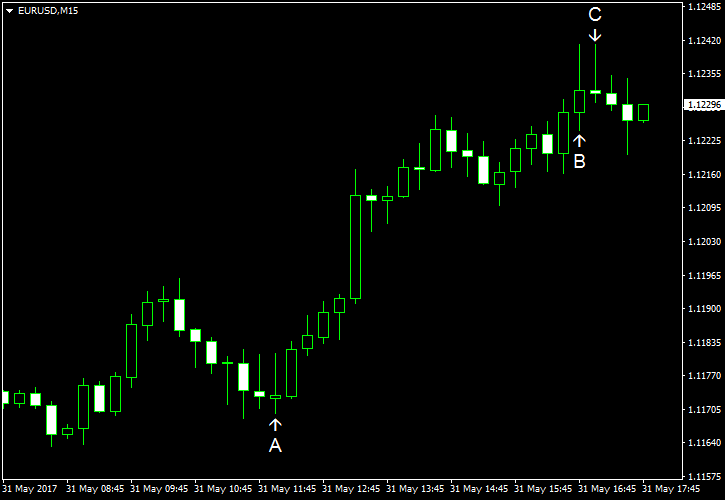

EUR/USD Pays No Heed to Slowing Eurozone Inflation

EUR/USD rallied today even though the report released during the trading session showed that eurozone inflation slowed, missing analysts’ expectations. (Event A on the chart.) Experts explained the euro’s good performance by expectations of discussion about stimulus exit at the next week’s policy meeting of the European Central Bank. Additionally, US macroeconomic data released over the current session was disappointing, helping the euro to solidify its gains versus the dollar. Chicago […]

Read more May 31

May 312017

USD/JPY Hits New 2-Week Low amid Strong Japanese Data and Mixed US Data

The USD/JPY currency pair today hit new 2-week lows as the US dollar grappled with increased selling pressure and low bond yields. The Japanese yen started gaining against the US dollar late in the Asian session, a trend which continued into the European and American sessions. The currency pair lost over 70 points from its daily high at the peak of its decline, but has since retraced some of its losses. […]

Read more May 31

May 312017

USD/JPY Hits New 2-Week Low amid Strong Japanese Data and Mixed US Data

The USD/JPY currency pair today hit new 2-week lows as the US dollar grappled with increased selling pressure and low bond yields. The Japanese yen started gaining against the US dollar late in the Asian session, a trend which continued into the European and American sessions. The currency pair lost over 70 points from its daily high at the peak of its decline, but has since retraced some of its losses. […]

Read more May 31

May 312017

Canadian Dollar Finds No Relief in Robust Growth of GDP

Canada’s gross domestic product grew in March more than was expected. Yet that brought no relief to the Canadian dollar as the currency dropped today, dragged down by the slump of crude oil prices. GDP increased 0.5% in March following no change in the previous month, exceeding the analysts’ median projection of 0.3%. The report said that the growth was broad-based across all the industries: Growth was widespread across goods-producing and service-producing […]

Read more May 31

May 312017

Canadian Dollar Finds No Relief in Robust Growth of GDP

Canada’s gross domestic product grew in March more than was expected. Yet that brought no relief to the Canadian dollar as the currency dropped today, dragged down by the slump of crude oil prices. GDP increased 0.5% in March following no change in the previous month, exceeding the analysts’ median projection of 0.3%. The report said that the growth was broad-based across all the industries: Growth was widespread across goods-producing and service-producing […]

Read more May 31

May 312017

GBP/USD Tumbles Lower Then Rallies Higher After Release of Opinion Poll Results

The GBP/USD currency pair today hit new weekly lows early in the European session before quickly retracing its losses and hitting new highs after the release of a PanelBase poll. The currency pair was on a downward trend after the release of a YouGov poll, which indicated that Theresa May‘s party might lose twenty seats in the upcoming elections. The currency pair gained over 150 points at the height of its rally to hit a daily […]

Read more May 31

May 312017

GBP/USD Tumbles Lower Then Rallies Higher After Release of Opinion Poll Results

The GBP/USD currency pair today hit new weekly lows early in the European session before quickly retracing its losses and hitting new highs after the release of a PanelBase poll. The currency pair was on a downward trend after the release of a YouGov poll, which indicated that Theresa May‘s party might lose twenty seats in the upcoming elections. The currency pair gained over 150 points at the height of its rally to hit a daily […]

Read more May 31

May 312017

Euro Largely Ignores Negative Macroeconomic Data

The euro rallied today, rising against the US dollar and the Japanese yen, as it largely ignored Europe’s macroeconomic indicators that were poor for the most part. With that said, the shared 19-nation currency trimmed its gains against the Great Britain pound (though it was rather the result of sterling’s strength rather than euro’s weakness) and slid versus the Swiss franc. Eurozone annual inflation slowed to 1.4% in May, down […]

Read more May 31

May 312017

Euro Largely Ignores Negative Macroeconomic Data

The euro rallied today, rising against the US dollar and the Japanese yen, as it largely ignored Europe’s macroeconomic indicators that were poor for the most part. With that said, the shared 19-nation currency trimmed its gains against the Great Britain pound (though it was rather the result of sterling’s strength rather than euro’s weakness) and slid versus the Swiss franc. Eurozone annual inflation slowed to 1.4% in May, down […]

Read more May 31

May 312017

US Dollar Drops Against Euro Despite Steady Interest Rates Outlook

The US Dollar dropped against the euro and other major currencies on Wednesday even as traders remained optimistic about an interest rate hike from the Federal Reserve in June. The Federal Open Market Committee will begin a meeting that will last two days on June 13 to review the US economic conditions and possibly raise interest rates. A slew of economic reports yesterday painted a lackluster picture of the health of the economy. Despite a small gain […]

Read more