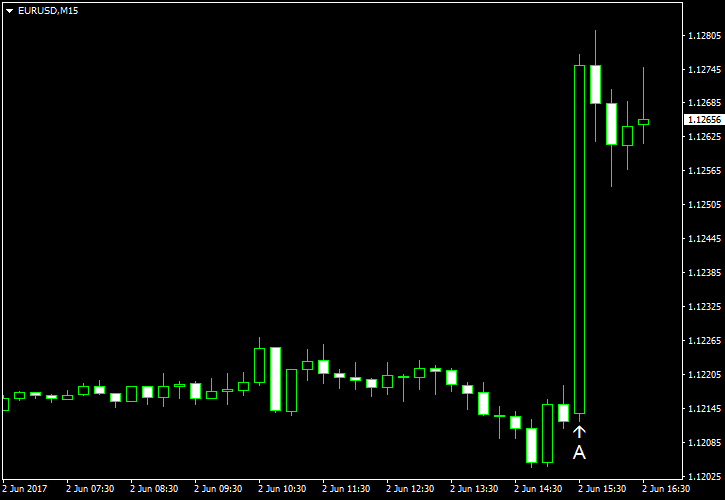

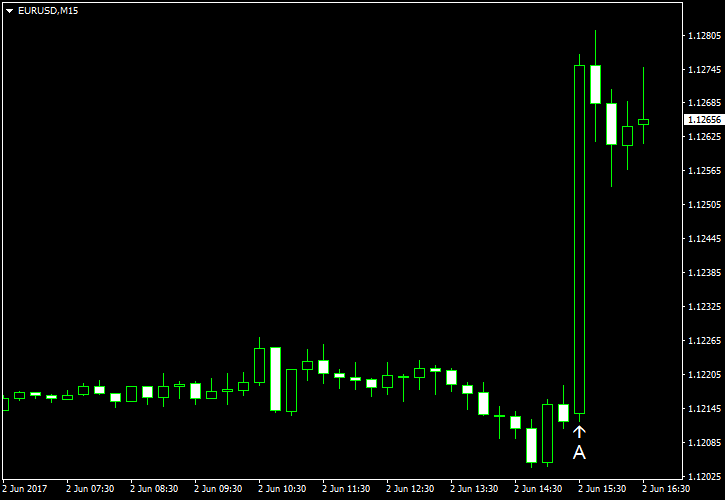

EUR/USD was moving gradually down today but jumped sharply after the release of nonfarm payrolls. Market participants were expecting a robust growth of US employment, but the reality turned out to be rather different. The actual figure was not disastrous, but it was far below expectations. The trade balance report was not good either, adding to the reasons for the dollar to go down versus the euro.

Nonfarm payrolls rose by just 138k in May, far less than the analysts’ optimistic forecast of 181k. What is more, the April’s figure was revised from 211k to 174k. Unemployment rate fell down from 4.4% to 4.3% while experts had not predicted any change. Average weekly earnings rose by 0.2%, exactly as was predicted and the same as the previous month’s revised rate of growth (which was at 0.3% before the revision). (Event A on the chart.)

Trade balance deficit was at $47.6 billion in April, up from $45.3 billion in March, revised ($43.7 billion before the revision). Specialists were expecting just a marginal increase to $45.5 billion. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.