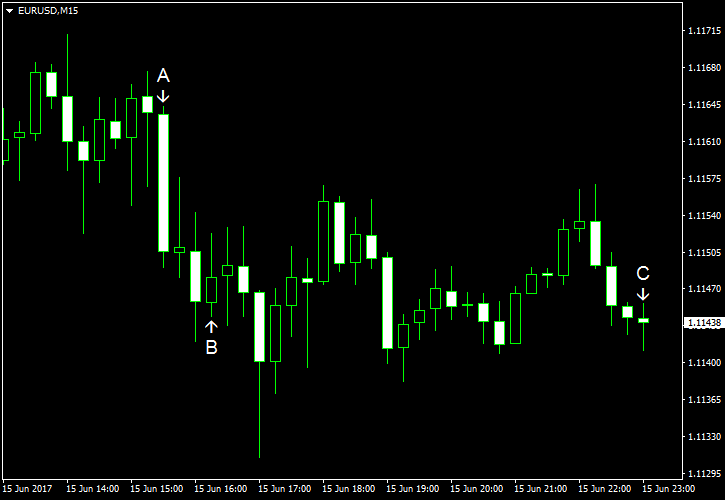

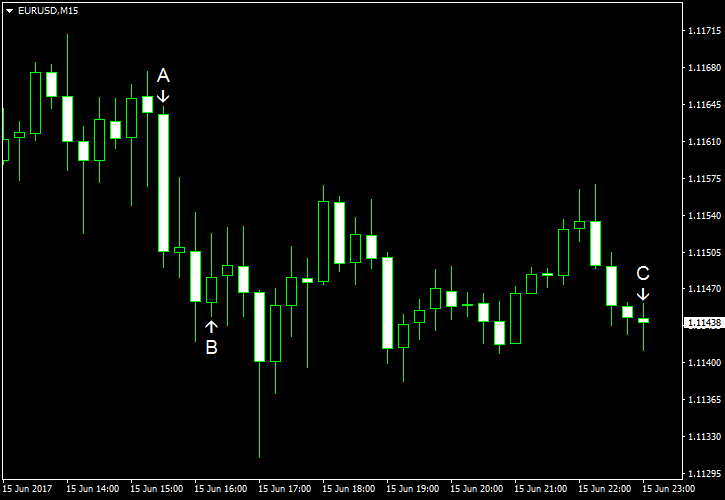

EUR/USD dropped today following yesterday’s interest rate hike from the Federal Reserve. Today’s economic reports released in the United States were mixed, but those that were good were sufficient to drive the dollar higher.

Initial jobless claims slipped from 245k to 237k last week. That is compared to the forecast value of 241k. (Event A on the chart.)

NY Empire State Index surged from -1.0 to 19.8 in June — the highest level in more than two years. It was far above the predicted figure of 5.2. (Event A on the chart.)

Import and export prices declined in May. Import prices fell 0.3% instead of rising by 0.1% as analysts had predicted. What is more, the April increase was revised from 0.5% to 0.2%. Export prices dropped 0.7% last month after increasing 0.2% the month before. (Event A on the chart.)

Philadelphia Fed manufacturing index declined from 38.8 in May to 27.6 in June. Still, the actual drop was not as big as the decline to 25.5 promised by experts. (Event A on the chart.)

Industrial production showed no change in May, whereas analysts predicted a 0.2% increase. The April gain got a small positive revision from 1.0% to 1.1%. Capacity utilization rate fell slightly from 76.7% to 76.6% instead of rising to 76.8% as forecasters promised. (Event B on the chart.)

Net foreign purchases were at $1.8 billion in April, missing the average forecast of $37.3 billion by a wide margin. The March value was at $59.7 billion (revised). (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.