- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 16, 2017

June 16

June 162017

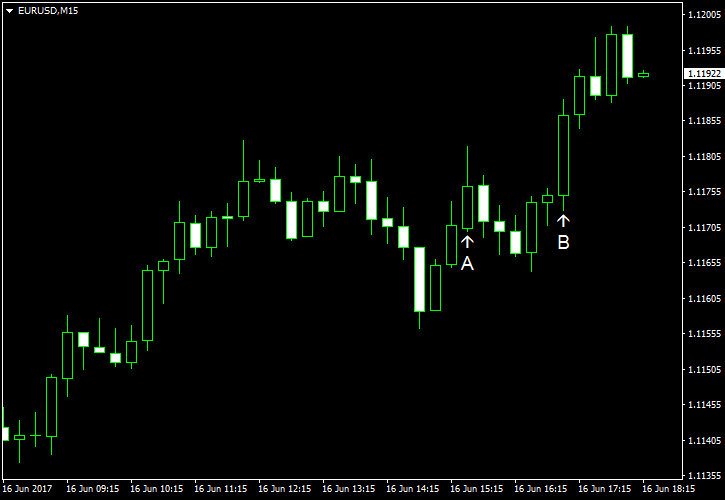

EUR/USD Rallies on Back of Surprisingly Poor US Data

EUR/USD rallied today thanks to poor economic data released in the United States over the trading session. Housing data and the consumer sentiment missed forecasts, falling unexpectedly. That drove the dollar down against other rivals. Both housing starts and building permits fell in May instead of rising as experts had predicted. Housing starts were down to the seasonally adjusted annual rate of 1.09 million from the previous month’s revised value […]

Read more June 16

June 162017

US Dollar Edges Lower Against Euro on Gloomy Consumer Outlook and Weak Housing Data

The US dollar edged lower against the euro on Friday to give up some of the gains it posted yesterday, as a gloomy outlook for consumer expectations dragged the greenback lower. Housing data released earlier today also weighed on the dollar, but did not overshadow the Federal Reserveâs decision to raise interest rates on Wednesday, which maintained some of the weekly gains of the US currency. The University of Michigan published a new reading for its consumer sentiment […]

Read more June 16

June 162017

US Dollar Edges Lower Against Euro on Gloomy Consumer Outlook and Weak Housing Data

The US dollar edged lower against the euro on Friday to give up some of the gains it posted yesterday, as a gloomy outlook for consumer expectations dragged the greenback lower. Housing data released earlier today also weighed on the dollar, but did not overshadow the Federal Reserveâs decision to raise interest rates on Wednesday, which maintained some of the weekly gains of the US currency. The University of Michigan published a new reading for its consumer sentiment […]

Read more June 16

June 162017

GBP/USD Consolidates Gains Ahead of Brexit Negotiations

The GBP/USD currency pair today rallied higher briefly after the release of weak US consumer confidence data during the North American session. The currency pair did not build on the upward momentum established during yesterday’s session after the Bank of England took on a hawkish tone. The currency pair was trading within a 20 point range for much of today’s session, but rallied higher by an extra 20 points after the data release […]

Read more June 16

June 162017

GBP/USD Consolidates Gains Ahead of Brexit Negotiations

The GBP/USD currency pair today rallied higher briefly after the release of weak US consumer confidence data during the North American session. The currency pair did not build on the upward momentum established during yesterday’s session after the Bank of England took on a hawkish tone. The currency pair was trading within a 20 point range for much of today’s session, but rallied higher by an extra 20 points after the data release […]

Read more June 16

June 162017

NZ Dollar Rebounds as Manufacturing Expansion Accelerates

The New Zealand dollar rebounded after yesterday’s slump versus the US dollar today and continued to rise against the Japanese yen for the fourth consecutive day. The seasonally adjusted BusinessNZ Performance of Manufacturing Index rose from 56.9 in April to 58.5 in May — the highest level since January 2016. The index was staying above the neutral 50.0 level, indicating expansion, since October 2016. The positive data allowed the New Zealand currency to recover […]

Read more June 16

June 162017

NZ Dollar Rebounds as Manufacturing Expansion Accelerates

The New Zealand dollar rebounded after yesterday’s slump versus the US dollar today and continued to rise against the Japanese yen for the fourth consecutive day. The seasonally adjusted BusinessNZ Performance of Manufacturing Index rose from 56.9 in April to 58.5 in May — the highest level since January 2016. The index was staying above the neutral 50.0 level, indicating expansion, since October 2016. The positive data allowed the New Zealand currency to recover […]

Read more June 16

June 162017

Japanese Yen Lower After BoJ Meeting

The Japanese yen fell today after the Bank of Japan maintained its ultra-loose monetary policy and did not discuss its stimulus-exit plans. The BoJ left its key interest rate at -0.1% and the size of the asset-purchase program at â¥80 trillion, exactly as was expected by market participants. But they were also expecting a discussion of plans for the eventual exit from the extremely accommodative policy and were disappointed as the central bank failed to mention such […]

Read more June 16

June 162017

Japanese Yen Lower After BoJ Meeting

The Japanese yen fell today after the Bank of Japan maintained its ultra-loose monetary policy and did not discuss its stimulus-exit plans. The BoJ left its key interest rate at -0.1% and the size of the asset-purchase program at â¥80 trillion, exactly as was expected by market participants. But they were also expecting a discussion of plans for the eventual exit from the extremely accommodative policy and were disappointed as the central bank failed to mention such […]

Read more