US housing data released today was very good, surprising market participants. It followed yesterday’s

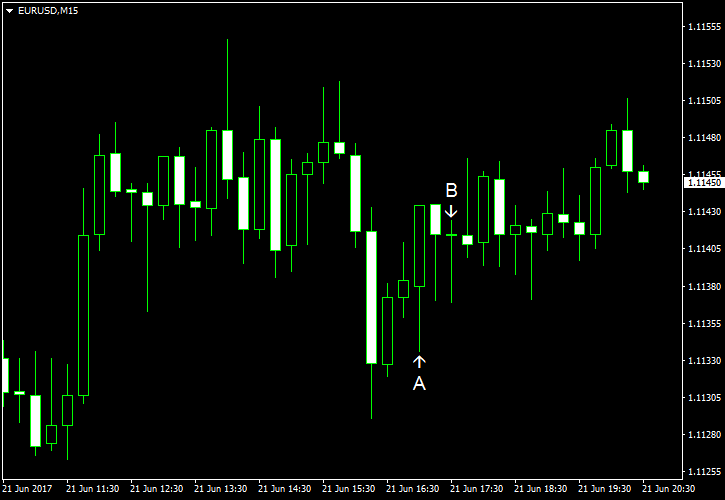

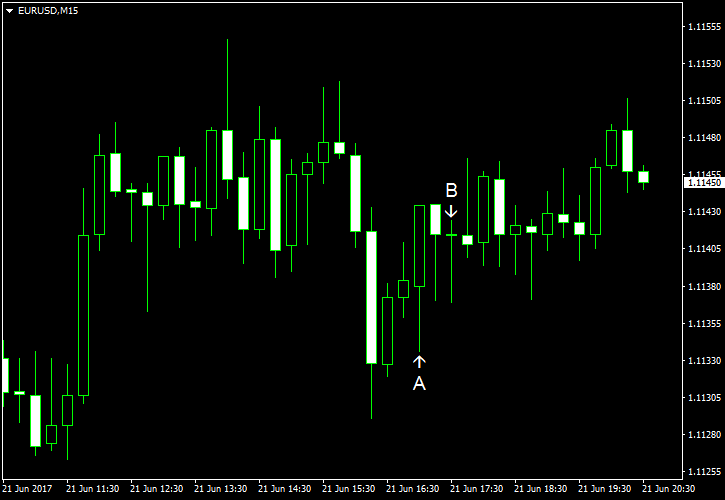

Existing home sales rose to the seasonally adjusted annual rate of 5.62 million in May from the downwardly revised 5.56 million in April. The median forecast promised a small drop to 5.54 million. (Event A on the chart.)

Crude oil inventories fell by 2.5 million barrels last week but remained in the upper half of the average range for this time of year. That is compared to the predicted drop by 1.2 million and the previous week’s decline by 1.7 million. (Event B on the chart.)

Yesterday, a report on current account balance was released, showing an increase from $114.0 billion in Q4 2016 to $116.8 billion in Q1 2017. Nevertheless, the actual reading was better than the predicted increase to $124.0 billion. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.