- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 22, 2017

June 22

June 222017

Norwegian Krone Rises After Central Bank’s Meeting, Crude Oil Rally

The Norwegian krone rose against the US dollar today after the nation’s central bank basically ruled out the possibility of an interest rate cut. The gains of crude oil also helped the currency. The Norges Bank kept its benchmark interest rate unchanged at 0.5% at today’s policy meeting. The central bank said that inflation was lower than expected but should rebound later. As for interest rates, bank’s Governor Ãystein Olsen […]

Read more June 22

June 222017

Norwegian Krone Rises After Central Bank’s Meeting, Crude Oil Rally

The Norwegian krone rose against the US dollar today after the nation’s central bank basically ruled out the possibility of an interest rate cut. The gains of crude oil also helped the currency. The Norges Bank kept its benchmark interest rate unchanged at 0.5% at today’s policy meeting. The central bank said that inflation was lower than expected but should rebound later. As for interest rates, bank’s Governor Ãystein Olsen […]

Read more June 22

June 222017

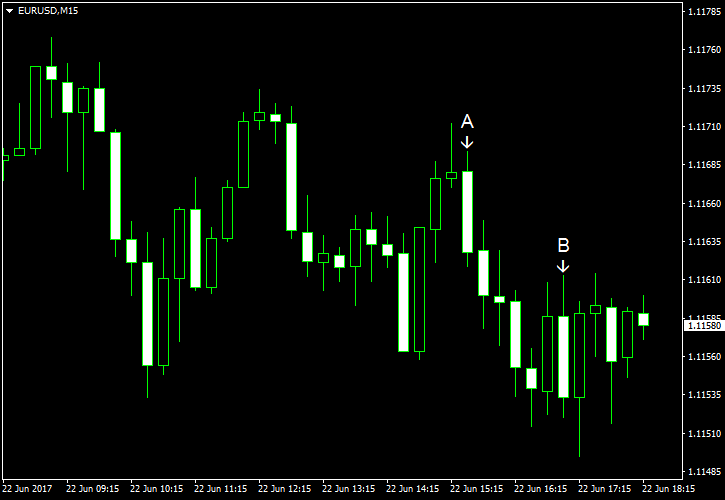

EUR/USD Logs Marginal Loss Despite US Data

EUR/USD fell today despite disappointing macroeconomic data from the United States. The drop was marginal, though, and was not enough to erase yesterday’s gains, which were not big themselves. Initial jobless claims rose to 241k last week from the previous week’s revised level of 238k, exactly as analysts expected. (Event A on the chart.) 241k last week rose 0.3% in May — a bit less than was predicted (0.4%). […]

Read more June 22

June 222017

Dollar Index Unchanged as Fundamentals Muddy

The US dollar was little changed today as US economic reports did not give the currency an edge and market participants were unsure whether the Federal Reserve will be able to carry on with its plan for three interest rate hikes in 2017. The Dollar Index was at 97.539 today, basically flat. US economic data released over the trading session was mixed. Unemployment claims rose a bit last week […]

Read more June 22

June 222017

Dollar Index Unchanged as Fundamentals Muddy

The US dollar was little changed today as US economic reports did not give the currency an edge and market participants were unsure whether the Federal Reserve will be able to carry on with its plan for three interest rate hikes in 2017. The Dollar Index was at 97.539 today, basically flat. US economic data released over the trading session was mixed. Unemployment claims rose a bit last week […]

Read more June 22

June 222017

British Pound Steadies, Shows Little Reaction to Positive Manufacturing Data

The British pound traded within a tight range against the euro and the US dollar on Thursday after erasing some of the gain it posted on Wednesday. Comments made by an official from the Bank of England pushed the British currency higher yesterday, despite lingering concerns about ongoing Brexit negotiations with the European Union. Bank of England Chief Economist Andy Haldane said in a speech yesterday that he believes interest rates in the United Kingdom […]

Read more June 22

June 222017

EUR/USD Trades in a Tight Range Despite Positive Eurozone Economic Bulletin

The EUR/USD currency pair today traded in a tight range despite the positive economic report released by European Central Bank during the European session. The US dollar was also flat during today’s session as tracked by the US Dollar Index, which was trading below its opening price of 97.55 for most of the day’s session. The currency pair was trading within a 30 point range for most of the day with a high being set […]

Read more June 22

June 222017

Canadian Dollar Surges Against US Peer on Solid Retail Sales in April

The Canadian dollar surged against the US dollar and the British pound on Thursday following the release of retail sales data for April, which revealed solid growth. The positive data came after a wholesale sales report earlier this week, which showed stronger than expected increase in the same month and improved investorsâ confidence in the Canadian economic growth. Statistics Canada, the nationâs official statistical office, released a retail trade report at 12:30 GMT […]

Read more June 22

June 222017

Japanese Yen Rises as Oil Falls, Trims Gains Later

The Japanese yen rose against other most-traded currencies as the drop of crude oil weighed on inflation in developed economies. The yen was rising today as US crude dropped to almost $42. Lower energy prices lead to lower inflation, and that hurt most currencies. Yet oil prices bounced later (to $42.72 as of now), making the yen trim its gains. USD/JPY was down from 111.37 to 110.94 intraday before trading at about […]

Read more June 22

June 222017

NZ Dollar Rallies After RBNZ Policy Meeting

The New Zealand dollar rose today after the monetary policy meeting of the Reserve Bank of New Zealand dollar, which was considered to be hawkish by market participants. The RBNZ kept its main interest rate at 1.75% as was widely expected. The central bank did not complain too much about the strength of the currency, even though it said: A lower New Zealand dollar would help rebalance the growth outlook towards […]

Read more