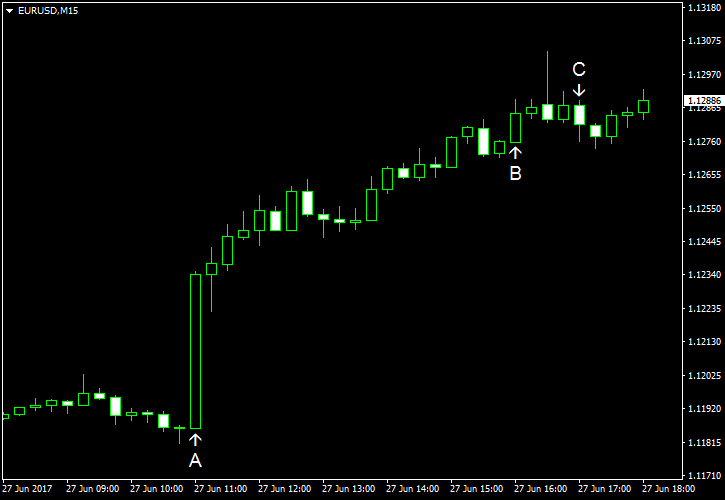

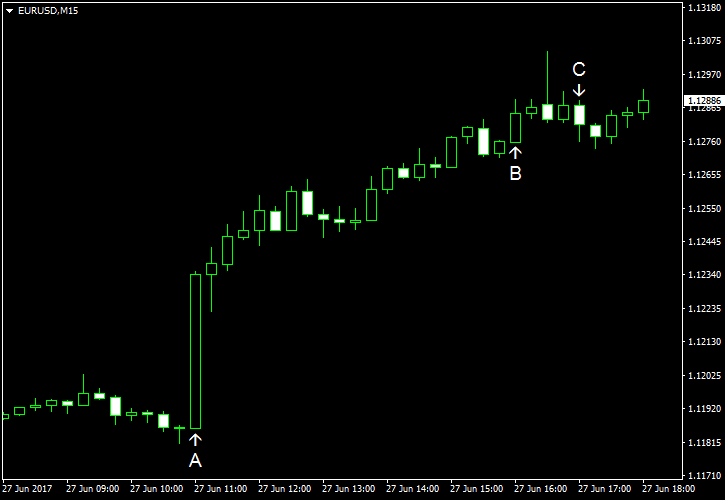

EUR/USD surged today after the speech of Mario Draghi, President of the European Central Bank. (Event A on the chart.) Markets considered his comments to be hawkish, that is why the currency pair reacted positively. Good US macroeconomic indicators halted the rally, but EUR/USD was still hanging near the day’s highs.

S&P/

Richmond Fed manufacturing index climbed from 1 in May to 7 in June, exceeding the median forecast that promised a value of 4. (Event C on the chart.)

Consumer confidence jumped from 117.6 in May to 118.9 in June instead of falling to 116.1 as analysts had predicted. (Event C on the chart.)

Yesterday, a report on durable goods orders was released, showing a drop by 1.1% in May. That is compared to the predicted decrease by 0.5% and the April fall by 0.8%. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.