- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 19, 2017

July 19

July 192017

Canadian Dollar Propelled by Economic Data & Oil Prices

The Canadian dollar gained on its major rivals today, propelled by positive macroeconomic data and gains of crude oil prices. Crude oil logged big gains, rallying more than 1% today. Crude advanced as US stockpiles decreased more than was expected, easing concerns about oversupply on the market. Canada’s manufacturing sales gained 1.1% in May, rising for the third consecutive month. The actual increase was above the median forecast […]

Read more July 19

July 192017

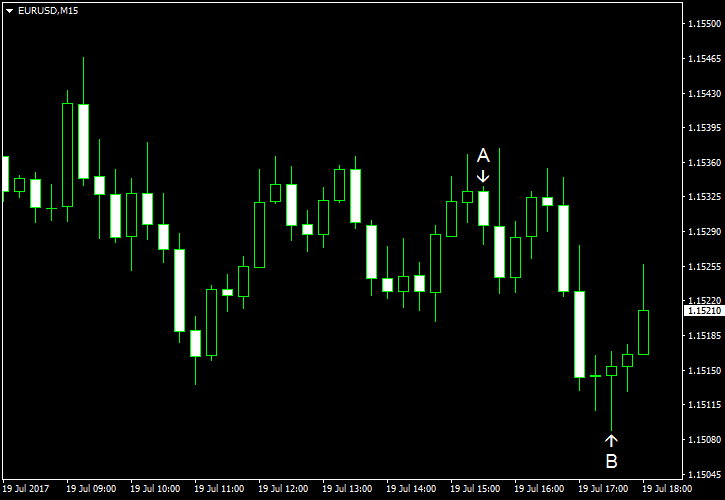

EUR/USD Inches Down Ahead of ECB Policy Announcement

EUR/USD inched down today as traders were waiting for tomorrow’s policy announcement from the European Central Bank. Today’s economic docket was almost empty, but the housing report released in the United States was good, helping the dollar to gain on the euro. Both housing starts and building permits climbed in June, rising above the levels forecast by analysts. Housing starts were at the seasonally adjusted annual rate of 1.22 million last month, […]

Read more July 19

July 192017

Pound Falls for Third Consecutive Session, Avoids Losses vs. Euro

The Great Britain pound fell today, declining for the third day in a row against its major rivals. The euro was an exception as the sell-off ahead of the policy announcement from the European Central Bank made the shared 19-nation currency even weaker than the currency of the United Kingdom. Previously, the sterling was getting support from expectations of monetary tightening from the Bank of England. But the central bank signaled that its decision will be […]

Read more July 19

July 192017

US Dollar Rises Against Main Counterparts on Strong Housing Data

The US dollar climbed against a basket of other major currencies on Wednesday, following the release of strong housing data that improved the short term outlook. The greenback still remained near its weakest level since the third quarter of last year after suffering from sharp losses over the past two weeks. In a joint report, the US Census Bureau and the US Department of Housing and Urban Development announced that building permits increased […]

Read more July 19

July 192017

NZ Dollar Gains on Market Sentiment, Pays No Heed to Inflation

The New Zealand dollar rose today on the positive market sentiment. Yesterday’s disappointing inflation data did not prevent today’s rally. Released yesterday, the Consumer Price Index showed no change in the June quarter from the previous three months. That is compared to the median forecast of a 0.2% growth and the 1.0% increase in the March quarter. Yet the market sentiment was favorable to riskier currencies, allowing the New Zealand dollar to largely ignore […]

Read more July 19

July 192017

Australian Dollar Rallies Undisturbed by Poor Data

The Australian dollar continued to rise today following yesterday’s surge. The poor macroeconomic data released over the current session did not bother the currency much. Yesterday’s rally was caused by the policy minutes of the Reserve Bank of Australia, which market participants considered hawkish. The notes showed that Australian policy makers targeted 3.5% as the neutral level for the key interest rate, and that is far above the current 1.5%. As for today’s data, […]

Read more