- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 27, 2017

July 27

July 272017

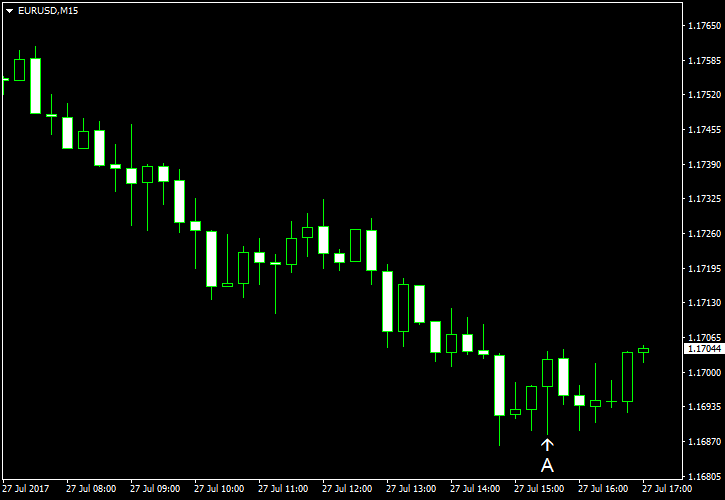

EUR/USD Backs Off from Multi-Year High

EUR/USD retreated today following yesterday’s rally but not before reaching the highest level since January 2015. Now, traders wait for US gross domestic product due to release tomorrow. The big increase of durable goods orders reported today gave hope to dollar bulls that GDP may be better than forecasts promised. Initial jobless claims rose from 234k to 244k last week. The average forecast […]

Read more July 27

July 272017

Turkish Lira Stable After Central Banks Maintains Tight Policy

The Turkish lira was stable against the US dollar after Turkey’s central bank decided at today’s meeting to keep interest rates unchanged. The Central Bank of the Republic of Turkey maintained its interest rates without change, including the Marginal Funding Rate that stayed at 9.25%. Such decision was expected by basically everyone as the central bank needs to keep monetary policy tight to combat two-digit inflation. Indeed, the bank said about […]

Read more July 27

July 272017

Turkish Lira Stable After Central Banks Maintains Tight Policy

The Turkish lira was stable against the US dollar after Turkey’s central bank decided at today’s meeting to keep interest rates unchanged. The Central Bank of the Republic of Turkey maintained its interest rates without change, including the Marginal Funding Rate that stayed at 9.25%. Such decision was expected by basically everyone as the central bank needs to keep monetary policy tight to combat two-digit inflation. Indeed, the bank said about […]

Read more July 27

July 272017

US Dollar Rallies Against Peers on Positive Durable Goods Orders

The US dollar today rallied against its main peers such as the euro and the Japanese yen after the release of positive US durable goods orders by the Census Bureau. The buying interest in the US dollar seems to have increased overnight, despite the FOMC maintaining interest rates at their current levels during yesterday’s meeting. The US Dollar Index, which tracks the greenback’s performance against its main trading partners, was trading above […]

Read more July 27

July 272017

US Dollar Rallies Against Peers on Positive Durable Goods Orders

The US dollar today rallied against its main peers such as the euro and the Japanese yen after the release of positive US durable goods orders by the Census Bureau. The buying interest in the US dollar seems to have increased overnight, despite the FOMC maintaining interest rates at their current levels during yesterday’s meeting. The US Dollar Index, which tracks the greenback’s performance against its main trading partners, was trading above […]

Read more July 27

July 272017

Australian Dollar Struggles to Keep Gains, Data Weighs

The Australian dollar rallied today, following yesterday’s policy statement from the Federal Reserve. The currency struggled to maintain gains, though, as today’s macroeconomic data was unfavorable. Yesterday, the Fed released a statement that was considered by most market participants to be dovish, and it bolstered riskier currencies. Yet the Aussie had troubles preserving bullish momentum, and the drop of Australia’s Import Price Index by 0.1% in the June from the previous three months […]

Read more July 27

July 272017

Australian Dollar Struggles to Keep Gains, Data Weighs

The Australian dollar rallied today, following yesterday’s policy statement from the Federal Reserve. The currency struggled to maintain gains, though, as today’s macroeconomic data was unfavorable. Yesterday, the Fed released a statement that was considered by most market participants to be dovish, and it bolstered riskier currencies. Yet the Aussie had troubles preserving bullish momentum, and the drop of Australia’s Import Price Index by 0.1% in the June from the previous three months […]

Read more July 27

July 272017

Brazilian Real Higher After Interest Rate Cut

The Brazilian real rallied against the US dollar today after the Federal Reserve released a dovish policy statement and Brazil’s central bank cut its key interest rate. The Central Bank of Brazil cut the Selic rate by one percentage point to 9.25%, in line with expectations. It was the first time since November 2013 when the interest rate was set below 10%. Moreover, the central bank signaled that it […]

Read more July 27

July 272017

Brazilian Real Higher After Interest Rate Cut

The Brazilian real rallied against the US dollar today after the Federal Reserve released a dovish policy statement and Brazil’s central bank cut its key interest rate. The Central Bank of Brazil cut the Selic rate by one percentage point to 9.25%, in line with expectations. It was the first time since November 2013 when the interest rate was set below 10%. Moreover, the central bank signaled that it […]

Read more