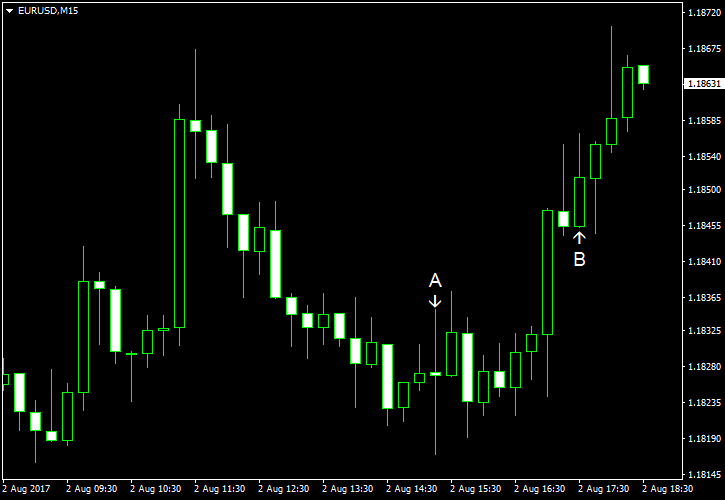

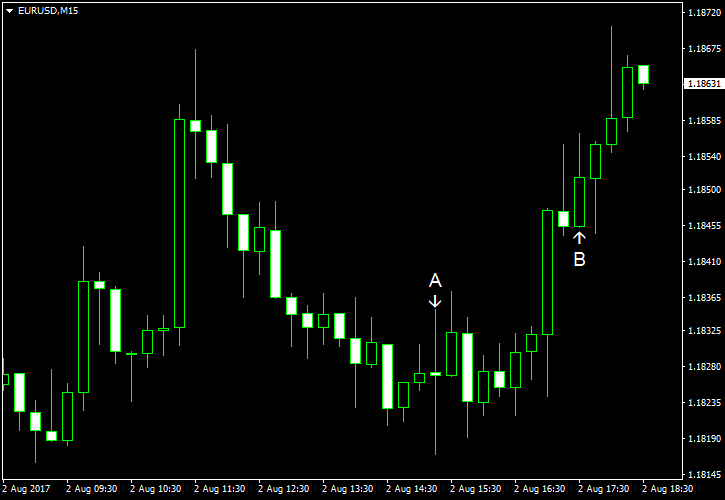

EUR/USD rallied to news highs today as US employment data trailed forecasts, adding to concerns that the economic situation does not warrant additional monetary tightening from the Federal Reserve. The really important piece of data, though, will be Friday’s nonfarm payrolls, which does not always correlate with the private ADP data.

ADP employment rose by 178k in July, missing the analysts’ average estimate of 187k. On a positive note, the June increase got a substantial positive revision from 158k to 191k. (Event A on the chart.)

Crude oil inventories shrank by 1.5 million barrels last week, though the drop was not as big as 3.2 million predicted by analysts and the huge decline by 7.2 million registered the week before. The inventories remained in the upper half of the average range for this time of year. Total motor gasoline inventories declined by 2.5 million barrels last week but also remained in the upper half of the average range. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.