- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 3, 2017

August 3

August 32017

USD/CAD Trims Gains as Traders Are Getting Ready for Friday’s Releases

The Canadian dollar trimmed losses versus its US counterpart as traders were getting ready for tomorrow’s employment data in the United States and Canada. The loonie was weak against other majors as crude oil dropped. Market participants wait for tomorrow’s nonfarm payrolls, hoping that the employment report will give hints whether the US economy is robust enough for the Federal Reserve to continue monetary tightening. Reports released earlier this […]

Read more August 3

August 32017

USD/CAD Trims Gains as Traders Are Getting Ready for Friday’s Releases

The Canadian dollar trimmed losses versus its US counterpart as traders were getting ready for tomorrow’s employment data in the United States and Canada. The loonie was weak against other majors as crude oil dropped. Market participants wait for tomorrow’s nonfarm payrolls, hoping that the employment report will give hints whether the US economy is robust enough for the Federal Reserve to continue monetary tightening. Reports released earlier this […]

Read more August 3

August 32017

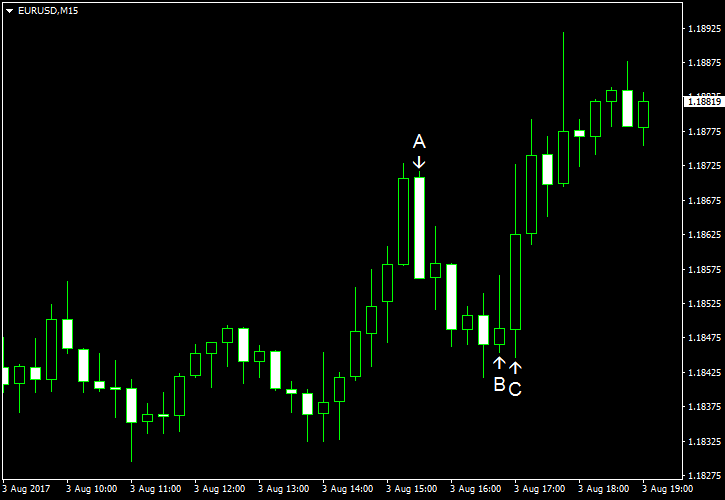

EUR/USD Falls as ISM Services PMI Trails Forecasts

EUR/USD rose today as the report about the US services industry released by the Institute for Supply Management today turned out to be worse than was predicted. Other reports were good, but that did not prevent the currency pair from rallying, though the rally was limited. Initial jobless claims fell from 245k to 240k last week, close to the forecast figure of 242k. (Event A on the chart.) Markit services PMI […]

Read more August 3

August 32017

US Dollar Remains near Lowest Level in 3 Years as Business Activity Lags Behind Forecast

The US dollar weakened against the euro on Thursday to remain near its lowest level in almost 3 years. A fresh data release that revealed lagging business activity in the United States added to mounting evidence that economic growth is losing momentum, which weighed on the greenback. The non-manufacturing purchasing managersâ index from the Institute for Supply Management lost 3.5 points, from 57.4 in June to 53.9 in July, according to a report published […]

Read more August 3

August 32017

US Dollar Remains near Lowest Level in 3 Years as Business Activity Lags Behind Forecast

The US dollar weakened against the euro on Thursday to remain near its lowest level in almost 3 years. A fresh data release that revealed lagging business activity in the United States added to mounting evidence that economic growth is losing momentum, which weighed on the greenback. The non-manufacturing purchasing managersâ index from the Institute for Supply Management lost 3.5 points, from 57.4 in June to 53.9 in July, according to a report published […]

Read more August 3

August 32017

Euro Rallies Higher Against US Dollar on Weak US ISM Data

The euro today rallied higher against the US dollar after the release of weak US ISM Services/Non-Manufacturing Composite data during the North American session. The EUR/USD currency pair was largely trading sideways during most of the European session due to the release of mixed Markit data from the Eurozone. The EUR/USD currency pair rallied to daily highs above 1.1870 after the release of the weak US ISM data. The Markit Italy Services PMI […]

Read more August 3

August 32017

Euro Rallies Higher Against US Dollar on Weak US ISM Data

The euro today rallied higher against the US dollar after the release of weak US ISM Services/Non-Manufacturing Composite data during the North American session. The EUR/USD currency pair was largely trading sideways during most of the European session due to the release of mixed Markit data from the Eurozone. The EUR/USD currency pair rallied to daily highs above 1.1870 after the release of the weak US ISM data. The Markit Italy Services PMI […]

Read more August 3

August 32017

British Pound Plunges Against US Dollar on BoE Rate Decision

The British pound today plunged to new lows after the Bank of England left its rates unchanged, while cutting the UK’s growth forecasts for this year. The pound hit new lows against the US dollar after the speech by the BOE Governor, Mark Carney, which painted a dovish economic outlook in relation to Brexit. The GBP/USD currency pair hit a yearly high of 1.3269 before the sharp drop witnessed after Mark Carney’s speech, […]

Read more August 3

August 32017

British Pound Plunges Against US Dollar on BoE Rate Decision

The British pound today plunged to new lows after the Bank of England left its rates unchanged, while cutting the UK’s growth forecasts for this year. The pound hit new lows against the US dollar after the speech by the BOE Governor, Mark Carney, which painted a dovish economic outlook in relation to Brexit. The GBP/USD currency pair hit a yearly high of 1.3269 before the sharp drop witnessed after Mark Carney’s speech, […]

Read more August 3

August 32017

Czech Koruna Advances After First Interest Rate Hike in Almost a Decade

The Czech koruna advanced against the US dollar today after the central bank decided to hike its key two-week repo rate. The Czech National Bank raised its main interest rate by 20 basis points to 0.25% and the Lombard rate by 25 basis points to 0.50%, while keeping the discount rate unchanged at 0.05%. Such decision was expected by some analysts. It the first change in borrowing costs since November 2012 […]

Read more