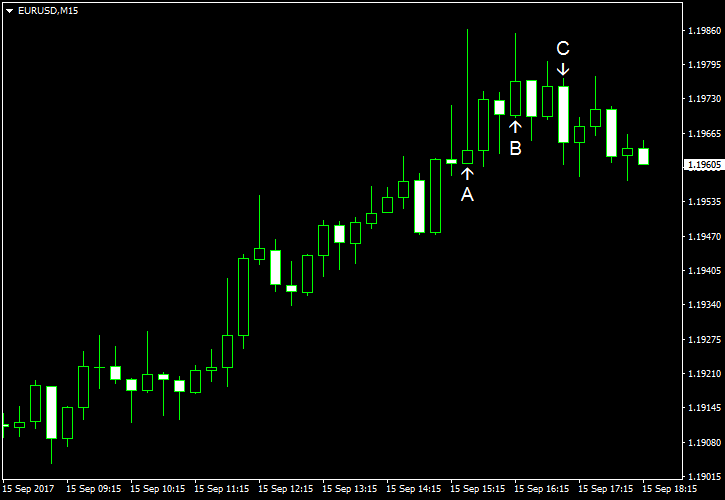

EUR/USD went higher today during the session that was busy in terms of macroeconomic data from the United States. Plenty of economic reports were released and unfortunately (at least for dollar bulls) quite a few of them were disappointing. Additionally, prospects for monetary tightening from the European Central Bank continued to support the currency pair.

Retail sales fell 0.2% in August, whereas experts had predicted an increase by 0.1%. Moreover, the July increase was revised from 0.6% down to 0.3%. (Event A on the chart.)

NY Empire State Index fell a bit from 25.2 in August to 24.4 in September. Still, the reading was better than 18.2 predicted by analysts. (Event A on the chart.)

Industrial production and capacity utilization fell in August. Industrial production was down 0.9%, completely missing the average forecast of a 0.1% growth. Capacity utilization was at 76.1%, below the consensus forecast of 76.8%. Both indicators received a positive revision to the July values — from an increase of 0.2% to a gain by 0.4% for industrial production and from 76.7% to 76.9% for capacity utilization (Event B on the chart.)

Michigan Sentiment Index was down from 96.8 in August to 95.3 in September according to the preliminary estimate. That was close to the analysts’ prediction of 95.1. (Event A on the chart.)

Business inventories rose 0.2% in July, exactly as forecasters had predicted. That is compared to the June increase of 0.5%. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.