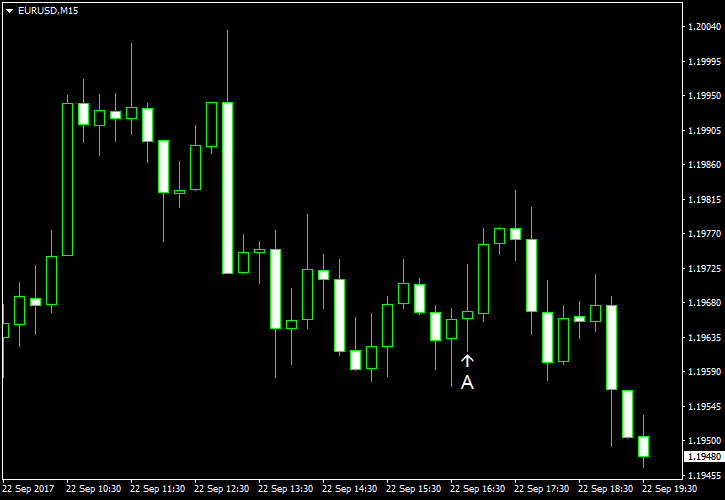

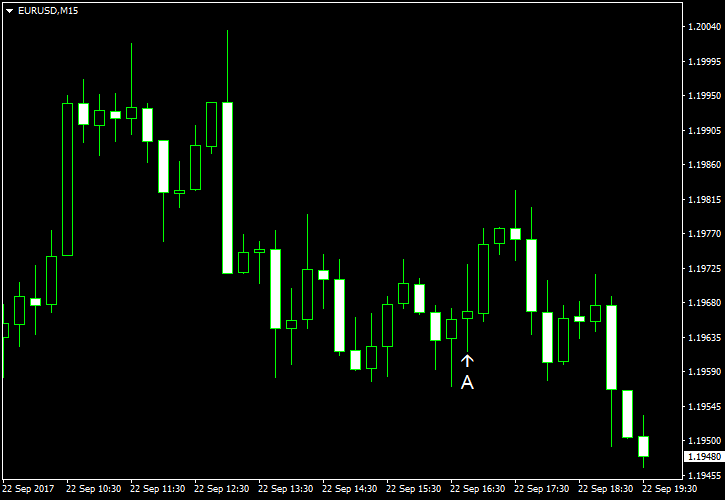

EUR/USD rallied during the first half of the current trading session but has drifted down closer to the opening level by now. The dollar was under pressure from growing tensions between the United States and North Korea. Meanwhile, the euro was getting support from the fact that all Purchasing Managers’ Indices released in the eurozone today (for major countries as well as for the currency union as a whole) were above expectations.

Markit US manufacturing PMI ticked up from 52.8 in August to 53.0 in September according to the flash estimate, in line with expectations. Markit US services PMI slipped from 56.0 to 55.1, below the average forecast of 55.8. (Event A on the chart.)

On Wednesday, several reports were released (not shown on the chart):

Existing home sales fell to the seasonally adjusted annual rate of 5.35 million in August from 5.44 million in July, while experts had expected the indicator to stay about the same.

Crude oil inventories swelled by 4.6 million barrels last week and were in the upper half of the average range for this time of year. That is compared to the predicted value of 2.8 million and the previous week’s print of 5.9 million. Total motor gasoline inventories decreased by 2.1 million barrels but remained in the upper half of the average range.

FOMC concluded its

Yesterday, there were several more releases (not shown on the chart):

Initial jobless claims dropped from 282k to 259k last week. That is instead of the forecast increase to 302k.

Philadelphia Fed manufacturing index climbed from 18.9 to 23.8 in September, whereas the median forecast had predicted a drop to 17.3

Leading indicators rose 0.4% in August. Specialists were anticipating the same 0.3% rate of growth as in July.

If you have any comments on the recent EUR/USD action, please reply using the form below.