EUR/USD dipped today amid speculations that a new Federal Reserve chief may be a hawk. Market participants consider a December interest rate hike almost a guarantee and think that another rate increase is possible in the first half of 2018. All that is bullish for the dollar, and the set of decent economic reports released in the United States today did not hurt the US currency either.

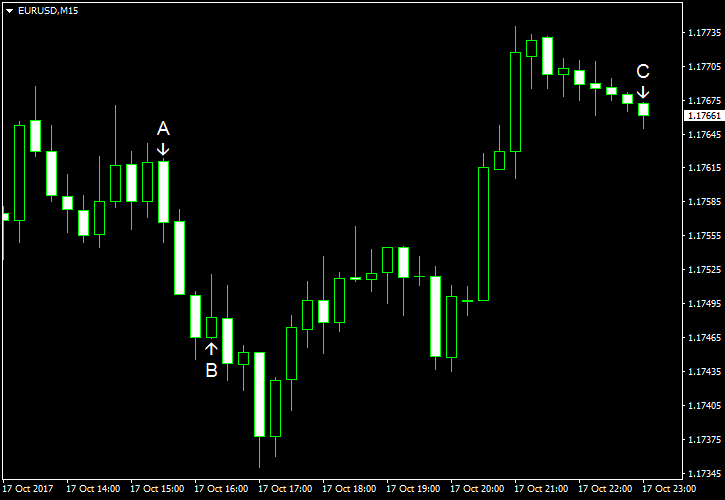

Import and export prices rose in September. Import prices were up 0.7%, while analysts were expecting the same 0.6% rate of growth as in August. Export prices increased 0.8% after rising 0.7% in the previous month. (Event A on the chart.)

Industrial production and capacity utilization also increased in September. Industrial production grew 0.3%, exactly as experts had predicted. The previous month’s drop was revised from 0.9% to 0.7%. Capacity utilization increased from 75.8% to 76.0%, though it missed the consensus forecast of 76.2%. (Event B on the chart.)

Net foreign purchases were at $67.2 billion in August, far above the July level of $1.2 billion and the analysts’ average estimate of $14.3 billion. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.