- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 2, 2017

November 2

November 22017

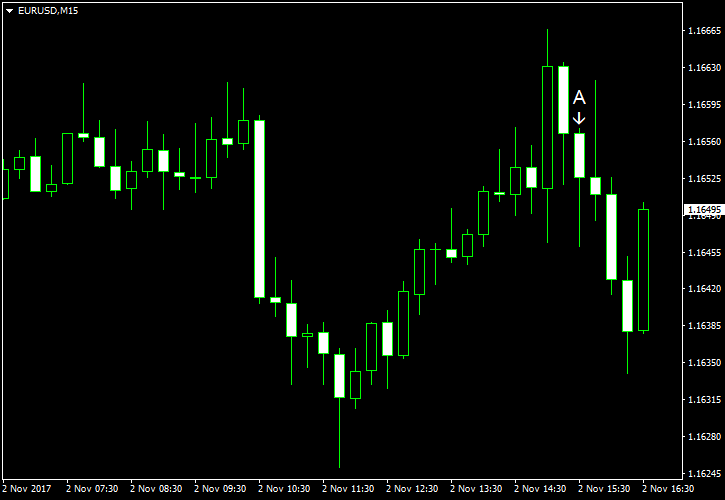

EUR/USD Volatile After Employment, Manufacturing Reports

EUR/USD was volatile on Wednesday, sinking after the ADP employment report but bouncing after the confusing manufacturing data. While the Markit indicator of manufacturing rose, the ISM indicator declined. The meeting of the Federal Open Market Committee turned to be non-event as the FOMC did not change it policy, nor it said anything particularly interesting. It looks like markets were more interested in the tax reform, which was delayed […]

Read more November 2

November 22017

EUR/USD Gains on Eurozone Manufacturing

EUR/USD traded higher today as manufacturing reports released in the eurozone over the trading session were very good for the most part. The gains were not big, though, and the currency pair pulled back after US jobless claims fell unexpectedly. Now, markets wait for an announcement of a new Federal Reserve chief and unveiling of a tax bill. Initial jobless claims dropped from 234k to 229k last week even though forecasts had […]

Read more November 2

November 22017

US Dollar Falls Against Euro Ahead of New Federal Reserve Chair Announcement

The US dollar declined against the euro on Thursday as investors anticipated the announcement of the new Federal Reserve Chair. The greenback failed to climb despite positive data releases today, which showed strong nonfarm productivity and fewer applications for unemployment benefits. US President Donald Trump is expected to announce his nomination for the new Federal Reserve Chair later today. Most traders expect the president to name Jerome Powell, who is a member […]

Read more November 2

November 22017

US Dollar Falls Against Euro Ahead of New Federal Reserve Chair Announcement

The US dollar declined against the euro on Thursday as investors anticipated the announcement of the new Federal Reserve Chair. The greenback failed to climb despite positive data releases today, which showed strong nonfarm productivity and fewer applications for unemployment benefits. US President Donald Trump is expected to announce his nomination for the new Federal Reserve Chair later today. Most traders expect the president to name Jerome Powell, who is a member […]

Read more November 2

November 22017

Czech Koruna Trades Higher Following Interest Rate Hike

The Czech koruna edged up against the US dollar during the current trading session after the nation’s central bank hiked its interest rates. The Czech National Bank increased its benchmark two-week repo rate by 25 basis points to 0.5%. The Lombard rate was up by 50 basis points to 1%, and the discount rate remained unchanged at 0.05%. The new interest rate level will come into effect tomorrow. USD/CZK […]

Read more November 2

November 22017

Czech Koruna Trades Higher Following Interest Rate Hike

The Czech koruna edged up against the US dollar during the current trading session after the nation’s central bank hiked its interest rates. The Czech National Bank increased its benchmark two-week repo rate by 25 basis points to 0.5%. The Lombard rate was up by 50 basis points to 1%, and the discount rate remained unchanged at 0.05%. The new interest rate level will come into effect tomorrow. USD/CZK […]

Read more November 2

November 22017

Pound Crashes After Dovish Hike by BoE

The Bank of England hiked its main interest rate for the first time in a decade as was widely expected, but markets considered the hike to be a dovish one. The Great Britain pound crashed as a result, falling more than 1% against its most-traded peers. The BoE increased its key interest rate from 0.25% to 0.5%, leaving the size of the asset purchase program unchanged at £435 billion. While it was considered a historical […]

Read more November 2

November 22017

Pound Crashes After Dovish Hike by BoE

The Bank of England hiked its main interest rate for the first time in a decade as was widely expected, but markets considered the hike to be a dovish one. The Great Britain pound crashed as a result, falling more than 1% against its most-traded peers. The BoE increased its key interest rate from 0.25% to 0.5%, leaving the size of the asset purchase program unchanged at £435 billion. While it was considered a historical […]

Read more November 2

November 22017

Swiss Franc Shrugs Off Poor Domestic Data

Economic data released in Switzerland today was rather poor, but that did not prevent the Swiss franc from rising against its most-traded peers during the current trading session. The possible reason for the good performance was risk aversion ahead of today’s important events. SECO consumer sentiment was at -2 in October, almost unchanged from -3 in the previous quarter, whereas analysts had expected an increase to 0. Retail […]

Read more November 2

November 22017

Swiss Franc Shrugs Off Poor Domestic Data

Economic data released in Switzerland today was rather poor, but that did not prevent the Swiss franc from rising against its most-traded peers during the current trading session. The possible reason for the good performance was risk aversion ahead of today’s important events. SECO consumer sentiment was at -2 in October, almost unchanged from -3 in the previous quarter, whereas analysts had expected an increase to 0. Retail […]

Read more