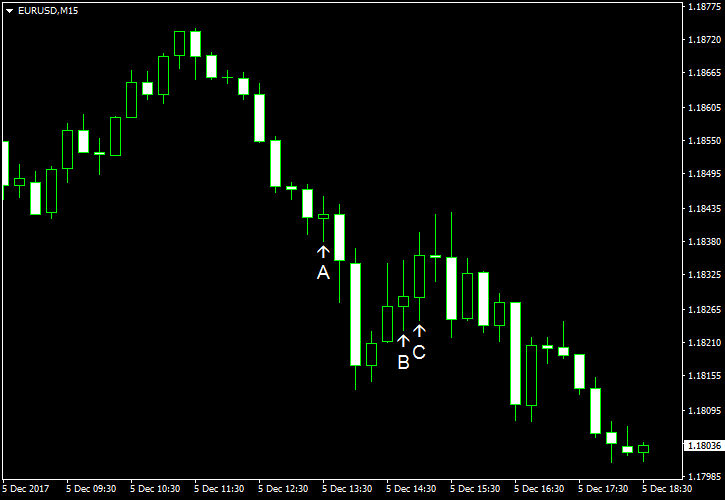

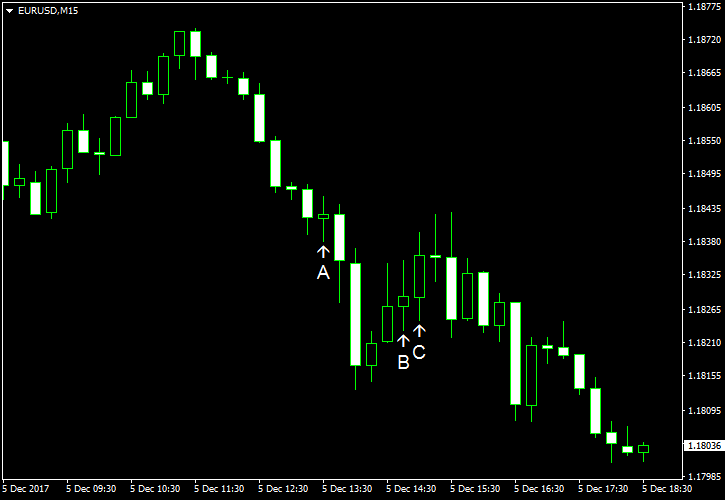

EUR/USD dropped today even though data released over the trading session revealed that growth of the US services sector slowed in November more than was expected. Market analysts attributed the dollar’s strength to the euphoria after the Senate passed its version of the tax reform bill on the weekend. Now, the Senate and the House of Representatives need to reconcile their versions of the bill, and markets may act erratically depending on the news they will hear.

US trade balance deficit widened to $48.7 billion in October from $44.9 billion in September (revised, $43.5 billion before the revision). Analysts had predicted a smaller gap of $46.2 billion. (Event A on the chart.)

Markit services PMI slid from 55.3 in October to 54.5 in November according to the final report. It was below the forecast value of 55.4 and the preliminary figure of 54.7. (Event B on the chart.)

ISM services PMI also fell, dropping from 60.1% to 57.4%, below the forecast reading of 59.2%. (Event C on the chart.)

Yesterday, a report on factory orders was released, showing a decrease of 0.1% in October. That is compared to the predicted drop by 0.3% and the previous month’s gain by 1.7%. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.