- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: December 20, 2017

December 20

December 202017

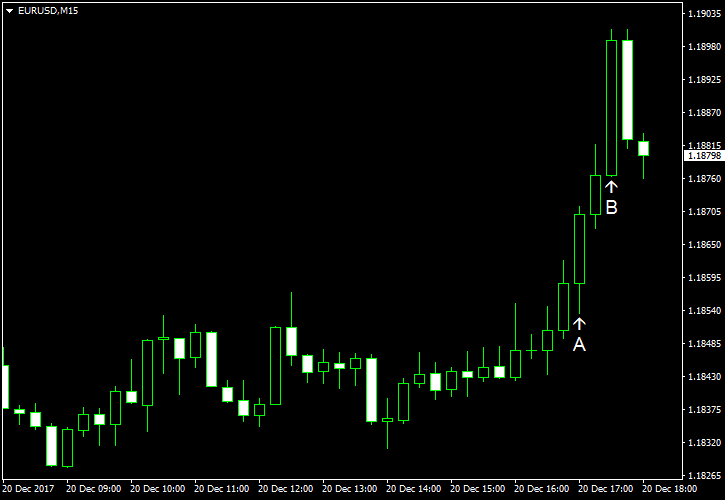

EUR/USD Trades Higher as US Congress Close to Passing Tax Reform Bill

EUR/USD rose today even as US Congress was very close to voting for the final version of the tax reform bill. Markets were apathetic to the news as the reform was priced in and trading was becoming lighter ahead of Christmas. Better-than-expected US housing data did not boost the dollar. Existing home sales jumped to the seasonally adjusted annual rate of 5.81 million in November from the upwardly revised 5.50 million in October. That was […]

Read more December 20

December 202017

US Dollar Doesn’t Respond Well to Good News

Today’s fundamentals looked positive for the US dollar with good housing data and the Congress voting for the final version of the tax reform bill. Yet the greenback did not respond well to the news, falling against almost all of its major rivals, with the exception of the Japanese yen. The Senate voted for the bill early Wednesday but had to sent it back to the House of Representatives, which passed it on Tuesday. It turned out that […]

Read more December 20

December 202017

Rand Continues to Rise, Analysts Expect Rally to Lose Steam

The South African rand continued to rise today, extending its rally caused by the Monday’s voting for the leadership of the ruling African National Congress. As was expected, South Africa’s ruling party got Cyril Ramaphosa as a new leader. Markets considered him to be business friendly. Because of that, the rand was rising ahead of the vote as investors were betting on him getting the post. The currency continued to rally even after the fact as traders refrained […]

Read more December 20

December 202017

British Pound Rallies Against US Dollar on Mark Carney’s Speech

The British pound today rallied higher against the US dollar after Mark Carney‘s testimony before the UK parliament, which was interpreted by investors as being quite hawkish. The pound was on an uptrend against the US dollar from the early European session despite the lack of any fundamental drivers due to the nearly empty UK economic docket. The GBP/USD currency pair rallied by over 40 points from a daily low of 1.3376 hit […]

Read more December 20

December 202017

Krona Gains as Riksbank Signals About Gradual Reduction of Stimulus

The Swedish krona rose today after the nation’s central bank kept its monetary policy unchanged but signaled that it is going to start gradually reduce stimulus in the future. The Riksbank left its main interest rate at -0.5% at today’s meeting but stated that it “is expecting, as before, to begin slowly raising the repo rate in the middle of 2018.” The bank explained, though, that it does not mean […]

Read more December 20

December 202017

New Zealand Dollar Stable Despite Underwhelming Data

The New Zealand dollar was stable today and even gained on the Japanese yen despite the fact that macroeconomic data released in New Zealand overnight was not good. New Zealand trade balance deficit widened from NZ$843 million in October to NZ$1,193 million in November, more than two times the forecast value of NZ$495 million. That was the first time since 2005 for a gap in November to rise above the NZ$1 billion […]

Read more