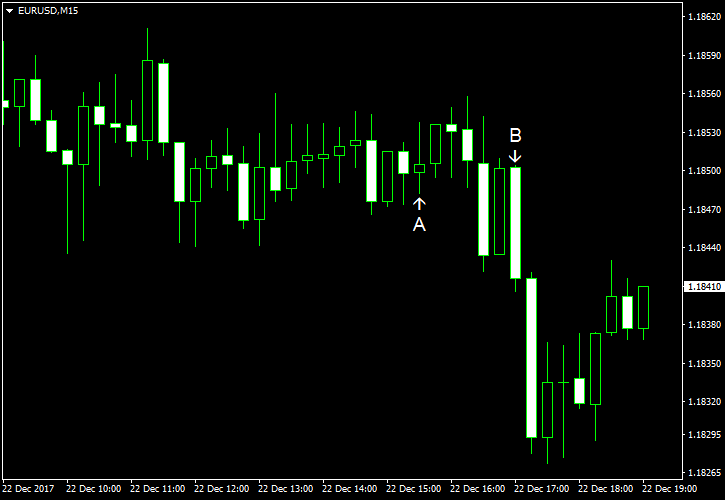

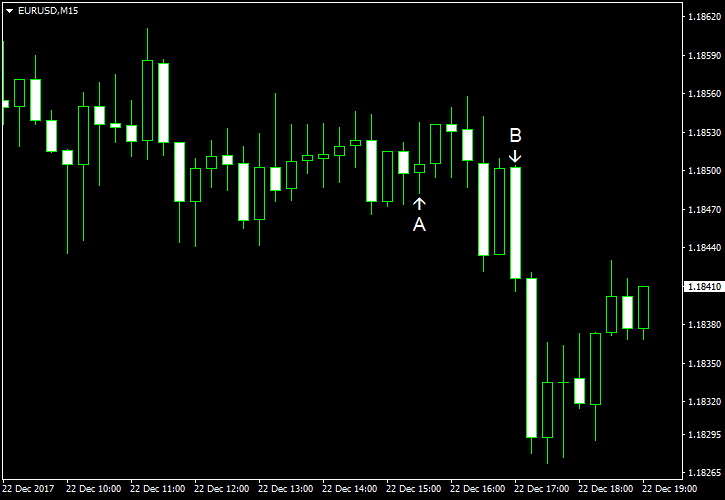

EUR/USD dropped today despite mixed economic data released in the United States over the trading session. The major reason for the drop was the victory of Catalan separatist parties, which gained majority in the parliament. The news sparked fresh worries for integrity of Spain and the future of the eurozone as a whole.

Durable goods orders rose 1.3% in November, failing to meet the average forecast of 2.1%. The previous month’s dropped got a positive revision from 1.2% to 0.8%. (Event A on the chart.)

Personal income and spending rose in November. Income was up 0.3%, while analysts had expected the same 0.4% rate of growth as in October. Spending increased 0.6%, more than was forecast (0.5%) and faster than in October (0.2%). Core PCE inflation was at 0.1%, slowing from the October’s reading of 0.2% and in line with market expectations. (Event A on the chart.)

New home sales rose to the seasonally adjusted annual rate of 733k in November from the October’s negatively revised level of 624k (685k before the revision). Experts had anticipated a smaller drop to 654k. (Event B on the chart.)

Michigan Sentiment Index dropped from 98.5 in November to 95.9 in December according to the final report. That was a smaller figure than 97.1 predicted by analysts and 96.8 logged in the preliminary report. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.