- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: December 27, 2017

December 27

December 272017

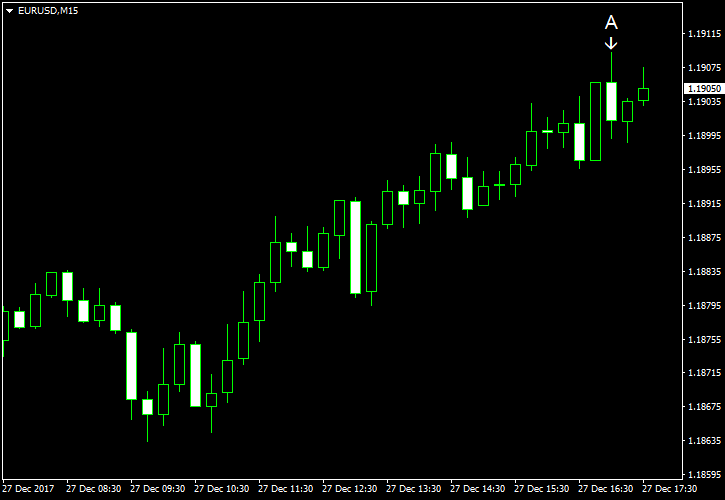

EUR/USD Rises During Slow Holiday Trading

EUR/USD rose during the Wednesday’s slow trading. With absence of any major fundamental drivers, traders flocked to riskier currencies, avoiding safer ones. US economic data was mixed as the housing market continued to show decent performance, while the consumer confidence tanked unexpectedly. Consumer confidence dropped to 122.1 in December from the negatively revised reading of 128.6 registered in November (129.5 before the revision). The actual drop was far bigger […]

Read more December 27

December 272017

USD/CAD Falls to 3-Week Lows on Oil Price Rally

The USD/CAD currency pair today fell to new 3-week lows as the Canadian dollar rallied against its US counterpart boosted by a rally in global oil prices. The release of US consumer confidence index for December also contributed to the currency pair’s decline as it did not meet expectations. The USD/CAD currency pair fell by about 70 points from a daily high of 1.2695 hit during the Asian session to a low of 1.2625 in the early American […]

Read more December 27

December 272017

Japanese Yen Weak Despite Housing Data

The Japanese yen was soft today against its most-traded rivals, with the exception of the safe haven currencies, even as macroeconomic data released during the current trading session in Japan was better than expected. According to the official data, the number of housing starts in Japan fell by 0.4% in November from a year ago. That was a far better reading than a drop by 2.5% predicted by analysts and the 4.8% slump registered in October. But […]

Read more December 27

December 272017

Euro Rallies Against US Dollar on Positive Investor Sentiment

The euro today rallied higher against the US dollar boosted by positive investor sentiment towards the single currency. The lack of any significant data from the Eurozone economic docket means that the single currency’s rally was not triggered by any fundamental drivers. The EUR/USD currency pair today rallied by about 45 points from a daily low of 1.1854 to hit a high of 1.1899, but could not overcome the crucial 1.1900 resistance […]

Read more December 27

December 272017

Australian Dollar Joins Rally of Commodity Currencies

The Australian dollar rose today, joining the other commodity currencies in the rally during holiday-thinned trade. Markets can act erratically during holidays, and today’s trading was a proof of that. There were no discernible reasons for commodity currencies to rally. In fact, quite the opposite was true as the sharp drop of crude oil prices should have dragged such currencies down. Yet that was not the case as currencies of Australia, Canada, […]

Read more