- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: December 28, 2017

December 28

December 282017

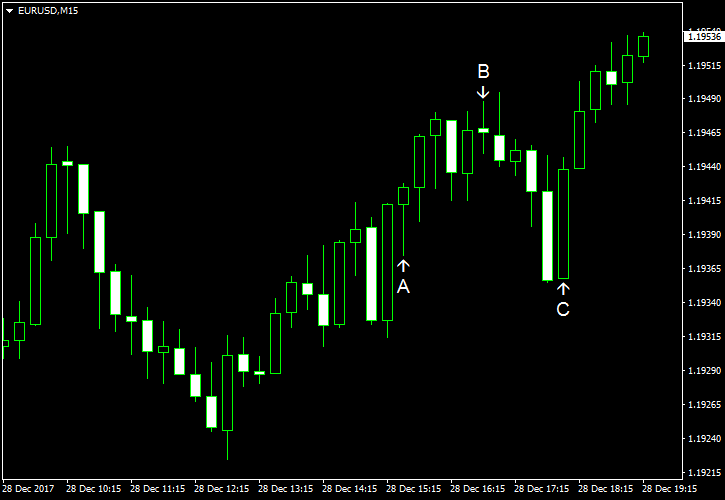

EUR/USD Continues to Rise Ahead of Year’s End

EUR/USD climbed today, maintaining its upward trend. US economic reports were mixed, but the good portion of the data barely slowed the rise of the currency pair. Initial jobless claims were at the seasonally adjusted rate of 245k last week, unchanged from the previous week’s unrevised level. Experts had hoped for a small drop to 240k. (Event A on the chart.) Chicago PMI climbed from 63.9 in November to 67.6 in December, ending the year […]

Read more December 28

December 282017

USD/CAD Declines to Trade near 2-Month Lows on Soft US Data

The USD/CAD currency pair today declined to trade near 2-month lows after the release of weak US advance goods trade balance data in the North American session. If the pair does not recoup its current losses, today would mark the seventh straight session in which the pair closes with a loss. The USD/CAD currency pair lost over 70 points to decline from a daily high of 1.2653 to a low of 1.2577 in the early […]

Read more December 28

December 282017

Euro Hits New Highs Against US Dollar on Weak US Trade Data

The euro today hit new highs against the US dollar after the release of soft US advance goods trade balance data among other releases. The EUR/USD currency pair today reversed a dip that occurred during the mid-European session boosted by falling US Treasury yields. The EUR/USD currency pair today rallied by over 50 points from a low of 1.1895 in the Asian session to a high of 1.1950 in the American session. The euro today […]

Read more December 28

December 282017

Aussie Pauses Rally, Bulls Unafraid

The Australian dollar fell today, but market analysts argued that it looks more like profit-taking after the strong rally than a trend-change. In fact, the Aussie continued to rise against its US counterpart, logging the sixth consecutive daily gain. Some economists theorized that the Australian dollar suffered as the surging US Treasury bond yields made investors take profit from higher-yielding currencies. It is not surprising […]

Read more December 28

December 282017

USD/JPY Drops on Japanese Data, BoJ Summary of Opinions

The Japanese yen gained on the very soft US dollar today thanks to better-than-expected macroeconomic data released in Japan over the trading session and signs that some policy makers want to end the era of ultra-loose monetary policy. The currency showed mixed performance versus other most-traded peers. The Bank of Japan released the Summary of Opinions at the monetary policy meeting that happened last week. It showed that some of the central bank’s members […]

Read more