EUR/USD was rising today, and the stellar employment data from Automatic Data Processing was unable to stop that. Some market analysts argued that the reason for that was risk appetite among investors. Others pointed out at the set of solid PMI figures released by Markit today as the reason for the euro’s gains on the dollar.

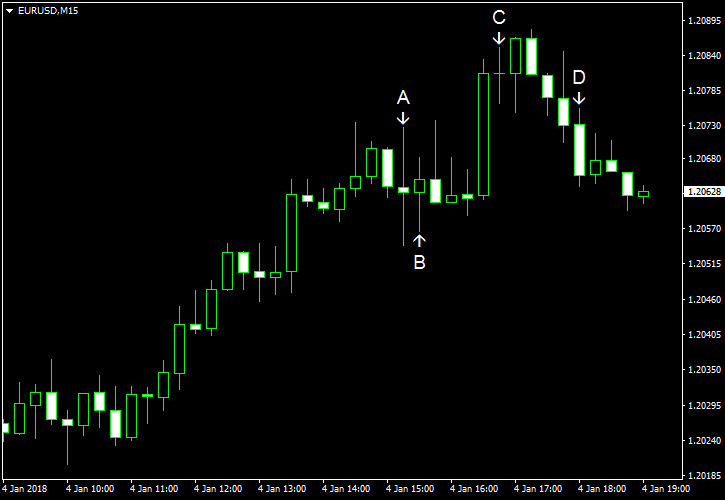

ADP employment rose by 250k from November to December. It was a far bigger growth than 191k predicted by experts and a revised 185k registered in the previous month. (Event A on the chart.)

Initial jobless claims rose from 245k to 250k last week on a seasonally adjusted basis. That was a surprise to analysts, who were counting on a decrease to 241k. (Event B on the chart.)

Markit services PMI was down from 54.5 in November to 53.7 in December according to the final estimate. Forecasters had predicted the same 52.4 reading as in the preliminary report. (Event C on the chart.)

US crude oil inventories dropped by as much as 7.4 million barrels last week. The drop exceeded the median forecast of 5.2 million and the previous week’s decrease of 4.6 million. The reserves still remained at the middle of the average range for this time of year. At the same time, total motor gasoline inventories increased by 4.8 million barrels and were in the upper half of the average range. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.