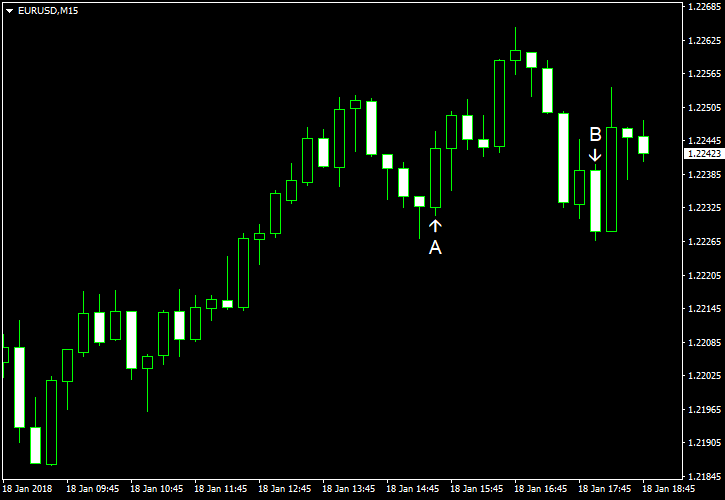

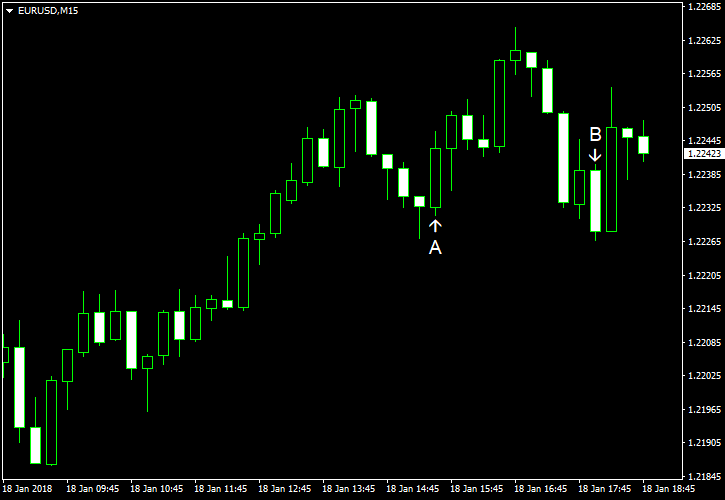

The US dollar had been falling against the euro throughout today’s trading session, but it had stopped its descent just before the New York trading session began. The rally in the EUR/USD currency pair was reignited by the release of the scheduled US macroeconomic statistics.

US housing starts and building permits failed to rise in December. Housing starts slumped from 1.30 to 1.19 million units despite the median forecast of 1.28 million. Building permits were virtually unchanged at 1.30 million units, matching the forecasts. (Event A on the chart.)

Philadelphia Fed manufacturing index decreased from 27.9 to 22.2 in January — the lowest reading in five months. Traders expected the indicator to only drop to 25.0. (Event A on the chart.)

Initial jobless claims demonstrated a surprise drop last week — they went down from 261k to 220k. A much higher reading of 249k was priced in by the market participants. Stronger employment situation may help the US Federal Reserve raise its interest rate faster in 2018. (Event A on the chart.)

Crude oil inventories declined by 6.9 million barrels during the week ending on January 12. The drop follows a 4.9 million barrels decrease registered a week earlier. Analysts had been predicting a decline by 3.2 million barrels. Total motor gasoline inventories rose by 3.6 million barrels during the same week — a bit slower than 4.9 million barrels added during the first week of the year. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.