- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 23, 2018

January 23

January 232018

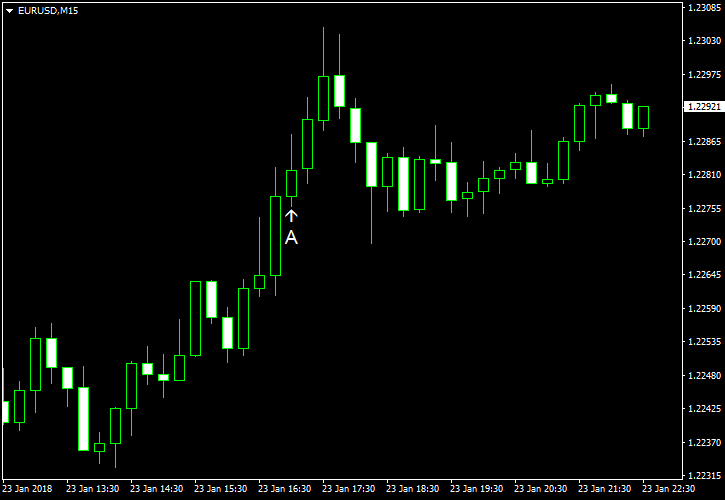

EUR/USD Rises with German Economic Sentiment

EUR/USD rose today following the release of the better-than-expected report about the German economic sentiment and continued to rise after the bigger-than-expected drop of the US manufacturing index. The currency pair was down before that as the dollar got boost from the reopening of the US government. Richmond Fed manufacturing index fell from 20 to 14 in January. That was a bigger drop than the one predicted by analysts, who had expected just a minor decrease […]

Read more January 23

January 232018

EUR/USD Rallies Higher on Positive German ZEW Survey

The EUR/USD currency pair today traded mostly in a tight range after heading lower in the Asian session and the early European session, before heading higher after the release of the German ZEW survey data. The pair’s initial downtrend was largely triggered by news that Congress had resolved the US government shutdown, which triggered a slight recovery in the greenback. The EUR/USD currency pair today traded in a 50-point range having hit a low of 1.2223 […]

Read more January 23

January 232018

Dollar Gains After US Government Reopens

The US dollar gained against the vast majority of most-traded currencies (with the exception of the Japanese yen) after the news that the US government is going to reopen. The Senate voted for and President Donald Trump signed the bill that ended the government shutdown. The bill was a stopgap measure, though, as the government stays opened just through February 8 unless a new agreement between politicians will be reached. Nonetheless, the dollar reacted positively […]

Read more January 23

January 232018

Yen Rises After BoJ Makes No Changes to Monetary Policy

The Japanese yen gained against its main rivals today after the Bank of Japan kept monetary policy without change. Positive macroeconomic data also provided some support, though its impact was subdued. The BoJ left the main interest rate at -0.1% and the size of annual asset purchases at ¥80 trillion as was widely expected. Analysts pointed out that the central bank said in the statement: Medium- to long-term inflation […]

Read more