To get the Asia AM Digest every day, SIGN UP HERE

Another day of an overall decline in sentiment thanks to increased trade war fears took its toll on the markets on Friday. The anti-risk Japanese Yen appreciated and the higher-yielding Australian and New Zealand Dollars depreciated. It began early in the day when US President Donald Trump ordered the consideration of additional $100b in tariffs against China. Asian stocks mostly finished in the red as a result.

What proceeded was almost inevitable, China’s Ministry of Commerce Spokesman Gao Feng announced that the country would take “immediate retaliation” if the US releases the additional $100b list. He added that they are ready and will not hesitate to retaliate. Around the same time, the US Dollar plunged as hawkish Fed policy expectations declined on a worse-than-expected local jobs report.

Speaking of the central bank, its Chairman Jerome Powell presented a speech towards the end of the day. Mr. Powell said that “further gradual rate hikes best promote Fed goals”. Commenting on the tariff developments, he added that they “don’t see any implications yet for the outlook”. While his comments didn’t bolster the greenback, the S&P 500 dropped in the aftermath of his speech.

Additional comments from Jerome Powell:

- Moderate wage gains show job market not excessively tight, feel good about strength of US financial sector

- Tariff discussions at relatively early stage. Tariffs can push up prices, too soon to quantify

- Time has come to look for more efficient financial regulations, sees wide agreement $50b threshold is too low

Meanwhile, US Treasury Secretary Steven Mnuchin also give his thoughts on ongoing US/China trade negotiations. He said that the “US objective is still not to be in a trade war with China” and that “there is a level of risk we could get into trade war”. The markets didn’t appear to take his latter comment too well, the S&P 500 closed the day 2.2% lower and the Dow Jones 2.3% to the down side.

Additional comments from Steven Mnuchin:

- US in communication with China regularly. Xi, Trump have ‘very good relationship’

- Tariffs on China will take time before taking effect. Cautiously hopeful to reach agreement with China

With that in mind, we will see how Monday’s trading session begins in the Asia/Pacific region. Over the weekend, Donald Trump had more to say about China. In his tweet, he mentioned “China will take down its trade barriers because it is the right thing to do”. He also added that “President Xi and I will always be friends”. If stocks echo the declines during the end of Friday’s session, the Japanese Yen could gain while its higher-yielding counterparts suffer.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

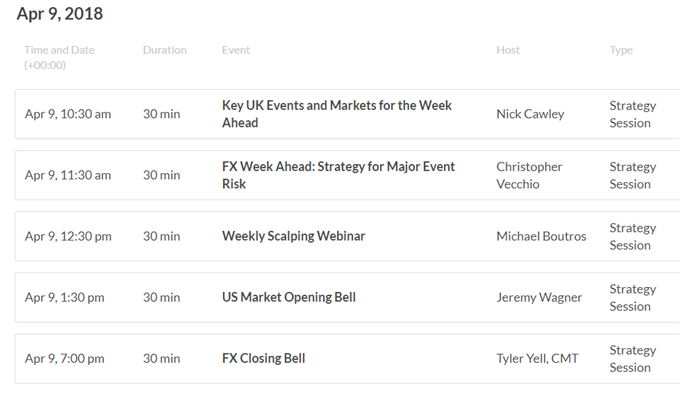

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

![]()

![]()

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 59.4% of USD/JPY traders are net-long with the ratio of traders long to short at 1.46 to 1. In fact, traders have remained net-long since Dec 29 when USD/JPY traded near 113.533; price has moved 5.7% lower since then. The number of traders net-long is 15.4% lower than yesterday and 14.1% lower from last week, while the number of traders net-short is 5.8% higher than yesterday and 22.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- EUR/USD Weekly Technical Outlook: Euro Set Up to Rally Next Week by Paul Robinson, Market Analyst

- Practicalities and Probabilities of Reversals: CAD, Dollar and S&P 500 by John Kicklighter, Chief Currency Strategist

- S&P 500 Tumbles as Trade War Headlines Revived, Dollar Range Resists NFPs by John Kicklighter, Chief Currency Strategist

- Australian Dollar Still Vulnerable To Global Trade Headlinesby David Cottle, Analyst

- Oil Looks to OPEC Monthly Report, US CPI and Trade Developmentsby Daniel Dubrovsky, Junior Currency Analyst

To get the Asia AM Digest every day, SIGN UP HERE

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here