Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

USD: Risk appetite has seemingly returned to the market with trade war risks slightly reduced. This came after comments from President Trump’s Economic Adviser Larry Kudlow who stated that the tariffs on China are just proposals right now, subsequently shifting to focus to negotiations. As such, the greenback is steadier, while equity markets have shown firm gains (DJIA futures pointing to a +100 point gain), which naturally has seen outflows from the safe-haven Yen with USD/JPY now flirting with the 107.00 handle.

GBP: UK Services PMI marked its weakest rise in 20-months, printing at a soft 51.7 missing expectations of 54 amid snow disruptions. This had also been the case for the Manufacturing and Construction PMI’s, with the latter slipping into contractionary territory. However, GBP/USD well anchored above 1.4000, given that the weather impacted PMI survey’s may suggest a temporary softness (possible recovery next month). As such, this is unlikely to deter the Bank of England to raise the bank rate next to 0.75%, OIS (Overnight Index Swaps) markets are pricing in roughly a 70% chance of a May rate hike.

AUD: Another soft session for the Australian Dollar despite overnight trade data, which showed a wider than expected surplus (825mln vs. Exp. 680mln). Although, softer global commodity prices, alongside cross selling in AUD/NZD, which has made a firm break below 1.0550 has kept a lid on AUD upside. AUD/NZD bears now looking towards 1.0500 as the next target to the downside.

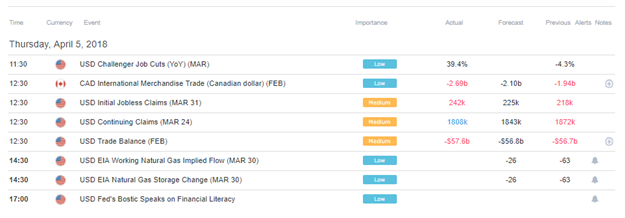

DailyFX Economic Calendar: Thursday, April 05, 2018 – North American Releases

In terms of today’s releases, initial jobless claims rose to a 3-month high at 242k against analysts forecasts for 225k. However, the 4-week average remains relatively low having risen 3k to 228.25k. This coupled with Wednesday’s stronger than expected ADP Employment Change data could suggest upside risk for Friday’s NFP report. The highly politicised trade balance deficit in the US shows no signs of improving with the deficit rising 1.6% to remain near a 10 year peak at USD 57.6bln, which had also been wider than the concensus for USD 56.8bln. Elsewhere, EIA natural storage change is due to be released for 14:30GMT, while Fed’s Bostic (Voter) will speak at 17:00GMT.

A bulk of the data out the way for North American participants with all eyes now firmly fixed on tomorrow’s US NFP report. Reminder, DailyFX analysts Christopher Vecchio, CFA and Michael Boutros will be covering the NFP release on Friday from 12:15 GMT.

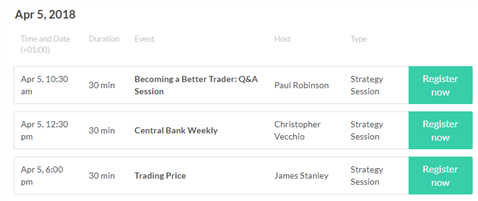

DailyFX Webinar Calendar: Thursday, April 05, 2018

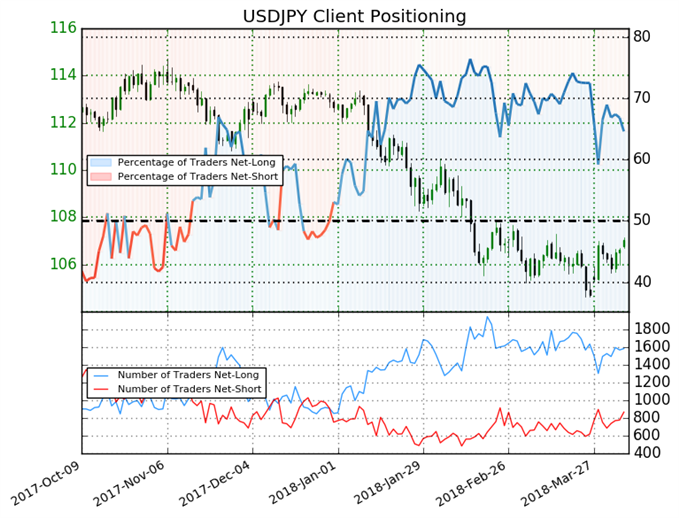

IG Client Sentiment Index Chart of the Day:

USDJPY: Retail trader data shows 65.2% of traders are net-long with the ratio of traders long to short at 1.87 to 1. In fact, traders have remained net-long since Dec 29 when USDJPY traded near 112.759; price has moved 5.1% lower since then. The number of traders net-long is 6.3% lower than yesterday and 9.4% higher from last week, while the number of traders net-short is 5.0% higher than yesterday and 6.9% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USDJPY trading bias.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Five Things Traders are Reading

- “Gold Remains in Symmetrical Triangle – Bullish Resolution Still Eyed” by Christopher Vecchio, Sr. Currency Strategist

-

“

Precious Metals Charts – Gold Back to Support, Silver Breakdown?”

by Paul Robinson, Market Analyst - “USDJPY Benefits as US/China Trade War Fears Ease” by Martin Essex, MSTA, Analyst and Editor

- “Gold Sell-Off May Continue as Traders Return to Risk” by Nick Cawley, Market Analyst

- “GBP Unchanged After Weakest UK Services PMI in 20 Months” by Justin McQueen, Market Analyst

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.