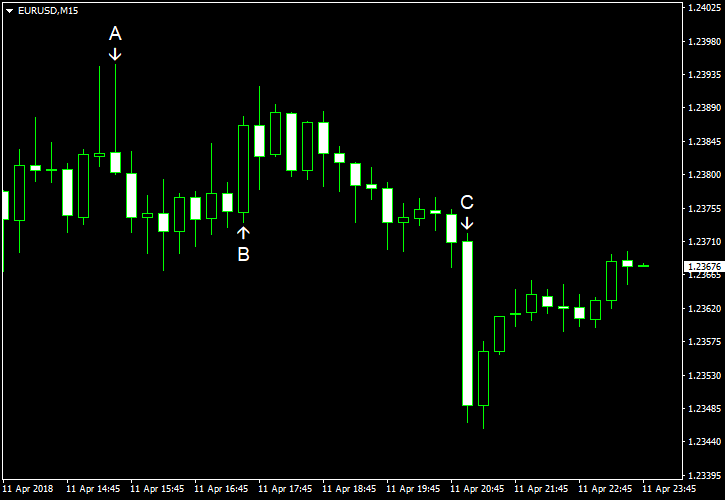

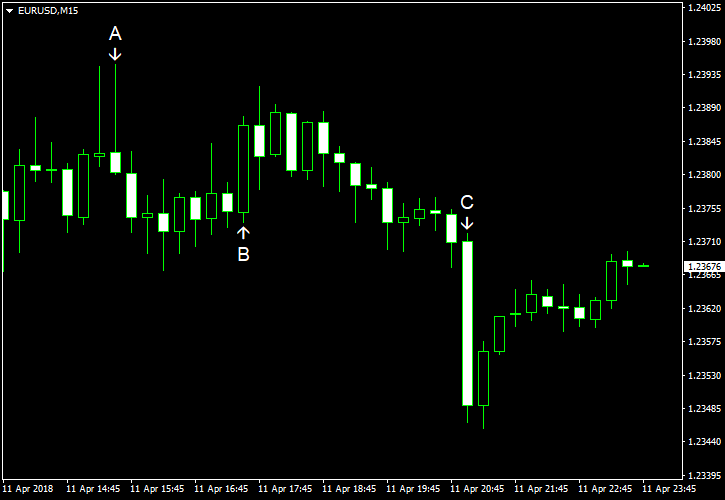

EUR/USD was gradually rising today but dipped after the Federal Open Market Committee released minutes of its March meeting, which were considered to be rather hawkish by market participants. Yet the currency pair has managed to recover a bit by now and is currently trading above the opening level.

US CPI decreased by 0.1% in March on a seasonally adjusted basis, whereas experts had anticipated no change. The index was up 0.2% in February. (Event A on the chart.)

Crude oil inventories swelled by 3.3 million barrels last week instead of falling by 0.6 million as analysts had predicted. Still, the stockpiles remained in the lower half of the average range for this time of year. (Event B on the chart.)

FOMC minutes of the March policy meeting revealed that some Committee members were talking about faster pace of interest rate hikes (event C on the chart):

A number of participants indicated that the stronger outlook for economic activity, along with their increased confidence that inflation would return to 2 percent over the medium term, implied that the appropriate path for the federal funds rate over the next few years would likely be slightly steeper than they had previously expected.

Treasury budget deficit shrank from $215.2 billion in February to $208.7 billion in March. It was still above the analysts’ projection of $191.0 billion. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.